Bunching charitable donations: A smart tax strategy

Enhance your charitable giving and tax savings with the smart strategy of bunching multiple years’ worth of contributions into a single year.

Did you know you could give more to the causes you care about and potentially save more on your taxes by bunching multiple years’ worth of contributions into one? You can potentially increase your tax savings by surpassing the standard deduction.

Tax reform has increased the standard deduction in 2025 to $15,750 for single filers and $31,500 for married filing jointly. In 2026 this has increased to $16,100 for single filers and $32,200 for married filing jointly, and many people may not have a large enough tax deduction to benefit from itemizing. One tax-efficient strategy is called bunching, where you group multiple years of deductions into a single year to surpass the standard deduction, which can also be especially beneficial in a high-income year or during pre-retirement.

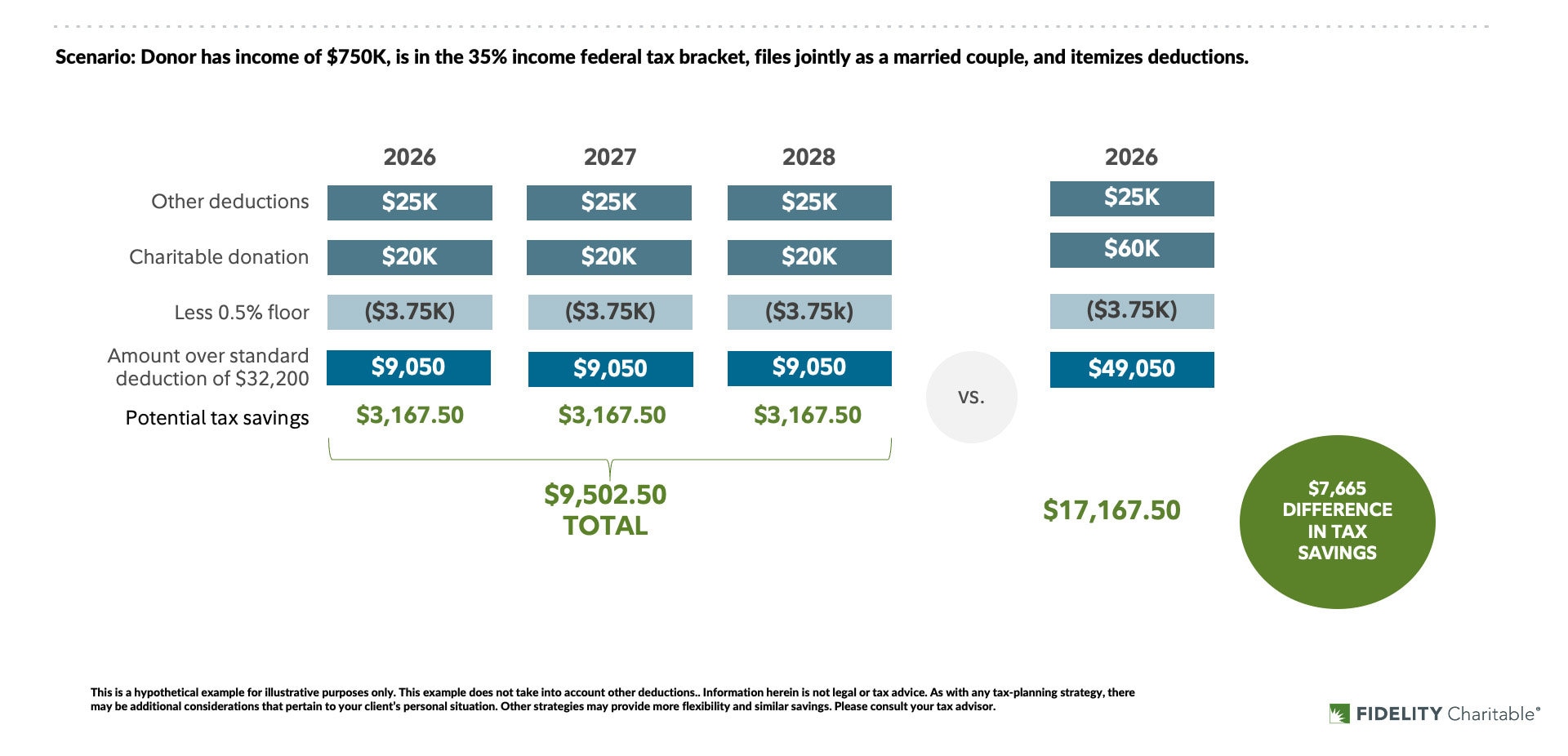

For example, if you bunch three years of charitable contributions into one year, you could exceed the standard deduction, which in turn would potentially result in a much greater tax savings.

Example

Let’s say you typically donate $20,000 each year to charity and claim $15,000 in mortgage interest and $10,000 in state and local taxes (SALT). Together, your itemized deductions total $45,000. In 2026, the standard deduction for married couples filing jointly is $32,200, so itemizing puts you $12,800 above the standard deduction—resulting in incremental tax savings of about $4,480 at a 35% income tax rate.

But if you bunch those three years of charitable deductions into a single year—making a one-time gift of $60,000—you may experience tax savings, especially in light of the new tax provisions passed with the One Big Beautiful Bill Act.

SALT: $10,000

Mortgage interest: $15,000

Charitable donation: $60,000

Total itemized deductions: $85,000

That’s $52,800 over the standard deduction, resulting in a potential tax savings of $17,167.50 with the added 0.5% AGI floor, compared to $9,502.50 over three years without bunching.

Want to see your own potential savings? Use our Charitable Giving Tax Savings Calculator to estimate how much you could save with bunching.

Bunching doesn’t mean you have to stop supporting your favorite charities annually. You can maintain giving consistency with a donor-advised fund like the Giving Account® from Fidelity Charitable®. When you contribute to Fidelity Charitable®, a public charity that sponsors a donor-advised fund program, you’re eligible for an immediate tax deduction in the year of your contribution. You can then recommend grants to qualified nonprofits over time, ensuring you maintain steady support while optimizing your tax benefits. Plus, the funds in your Giving Account® have the potential to grow tax-free, which can mean making an even greater impact on the causes you care about.

Want more information on donor-advised funds?

The tax information provided is general and educational in nature and should not be construed as legal or tax advice. Fidelity Charitable does not provide legal or tax advice. Content provided relates to taxation at the federal level only. Charitable deductions at the federal level are available only if you itemize deductions. Rules and regulations regarding tax deductions for charitable giving vary at the state level, and laws of a specific state or laws relevant to a particular situation may affect the applicability, accuracy, or completeness of the information provided. As a result, Fidelity Charitable cannot guarantee that such information is accurate, complete, or timely. Tax laws and regulations are complex and subject to change, and changes in them may have a material impact on pre- and/or after-tax results. Fidelity Charitable makes no warranties with regard to such information or results obtained by its use. Fidelity Charitable disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Always consult an attorney or tax professional regarding your specific legal or tax situation. Fidelity Charitable is the brand name for the Fidelity Investments® Charitable Gift Fund, an independent public charity with a donor-advised fund program. Various Fidelity companies provide services to Fidelity Charitable. The Fidelity Charitable name and logo and Fidelity are registered service marks of FMR LLC, used by Fidelity Charitable under license.

How Fidelity Charitable can help

Since 1991, we have been helping donors like you support their favorite charities in smarter ways. We can help you explore the different charitable vehicles available and explain how you can complement and maximize your current giving strategy with a donor-advised fund. Join more than 395,000 donors who choose Fidelity Charitable to make their giving simple and more effective.

Ready to get started?

Opening a Giving Account is fast and easy, and there is no minimum initial contribution.

Or call us at 800-262-6039