Benefits of the Giving Account

- Support the same charities you do now

- Streamline your tax recordkeeping in one convenient location

- Donate cash, stocks, private business interests and more

- Grow your donation*

* Donations are invested and investing involves risk. The value of an invested donation will fluctuate over time and may gain or lose money.

How it works

Donate cash, stocks, or non-publicly traded assets to your Giving Account and get your tax receipt.

When you donate to your Giving Account, you can take the same tax deductions as donating to any public charity.

- If you donate cash, via check, wire transfer or credit card,* you're generally eligible for an income tax deduction up to 60% of your adjusted gross income (AGI).

- However, if you have long-term appreciated assets, such as stocks or bonds, you have an opportunity to further maximize your deduction. By donating these types of assets directly to charity, you generally won't have to pay capital gains and you can take an income tax deduction in the amount of the full fair-market value, up to 30% of your AGI.

*Please note, you cannot use a credit card to donate to Fidelity Charitable.

To be eligible for a tax deduction this year, you may need to initiate your donation early. While some assets take longer to accept and process than others, our outlined dates are meant to be used as guidelines. Please call us with any questions regarding which assets we accept and the time required for processing.

Contributions must be received by December 31 to be eligible for a tax deduction this year.

You can support 501(c)(3) IRS-qualified public charities with the money you've put into your Giving Account.

Fidelity Charitable requires active grantmaking from every Giving Account. Each individual grant must be at least $50, and you must recommend at least one grant every two years. If no grants are made within that time, Fidelity Charitable will make a grant from the Giving Account in an amount determined by the Trustees of Fidelity Charitable to an eligible grant recipient approved by the Trustees.

There is no maximum contribution limit to your Giving Account at Fidelity Charitable. However, the amount you can deduct for tax purposes each year may be limited based on IRS rules. Any excess contributions that exceed the deduction limit can typically be carried forward for up to five additional years. Consult a tax advisor to determine the best strategy for your charitable giving.

While you're deciding which charities to support, your donation can grow based on how you tell us you would like it to be invested, so your Giving Account can potentially have even more money for charities.

Like with any investment strategy, diversifying assets in a Giving Account with a suitable asset allocation is critical to help donors meet their specific charitable goals. From asset allocation pools, which offer diversification through an all-in-one, risk-based approach, to both passive and actively-managed broad market investments, we have something that will meet your specific investing style. We also have sustainable and impact investing options for those donors that want exposure to strategies that consider social and environmental factors, while also emphasizing financial returns.

You can also give your advisor access to your Giving Account to help you decide.

Yes. Just like any investment, invested donations depend on market performance. A diversified investment approach can help manage risk in your Giving Account and rebalancing is an important key to maintaining the most appropriate risk level, based on your charitable goals, over time. The Asset Allocation pools offer diversified all-in-one investment options, based on your risk tolerance level and time horizon, and are automatically rebalanced—taking the guess work out of the asset allocation decision process for our donors. Keep in mind that any decreases will not affect your tax deduction, as you would have already made a deductible contribution to Fidelity Charitable.

Yes, we have a number of resources available to help guide your investment recommendations regardless of your situation and charitable goals. Our Asset Allocation pools are all-in-one investment options that are professionally managed and available to all donors. For help in determining the right Asset Allocation pool for your goals, we created the Pool Selector tool. Plus, if your Giving Account reaches a qualified minimum balance, you’ll be eligible for our Charitable Investment Advisor Program, which allows you to nominate your own financial advisor to manage your Giving Account’s investments.

The Charitable DonorFlex Program—or DonorFlex—is for donors with more than $5 million in their Giving Account who desire flexibility beyond what investment pools offer. DonorFlex allows donors to recommend that their Giving Account assets be invested in hedge funds, private equity funds, mutual funds, treasuries and ETFs.

Make your tax-deductible donation to us

Donate cash, stocks, or non-publicly traded assets to your Giving Account and get your tax receipt.

When you donate to your Giving Account, you can take the same tax deductions as donating to any public charity.

- If you donate cash, via check, wire transfer or credit card,* you're generally eligible for an income tax deduction up to 60% of your adjusted gross income (AGI).

- However, if you have long-term appreciated assets, such as stocks or bonds, you have an opportunity to further maximize your deduction. By donating these types of assets directly to charity, you generally won't have to pay capital gains and you can take an income tax deduction in the amount of the full fair-market value, up to 30% of your AGI.

*Please note, you cannot use a credit card to donate to Fidelity Charitable.

To be eligible for a tax deduction this year, you may need to initiate your donation early. While some assets take longer to accept and process than others, our outlined dates are meant to be used as guidelines. Please call us with any questions regarding which assets we accept and the time required for processing.

Contributions must be received by December 31 to be eligible for a tax deduction this year.

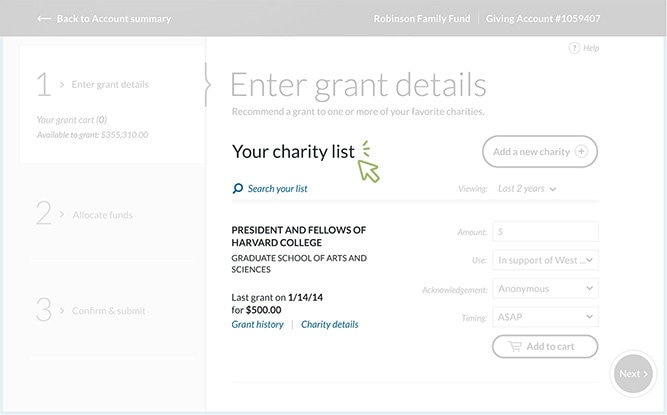

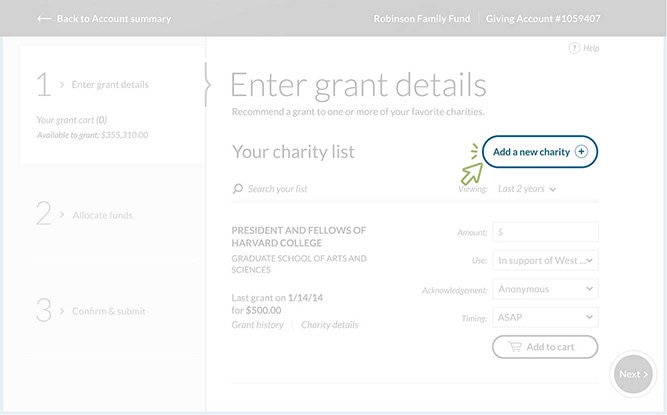

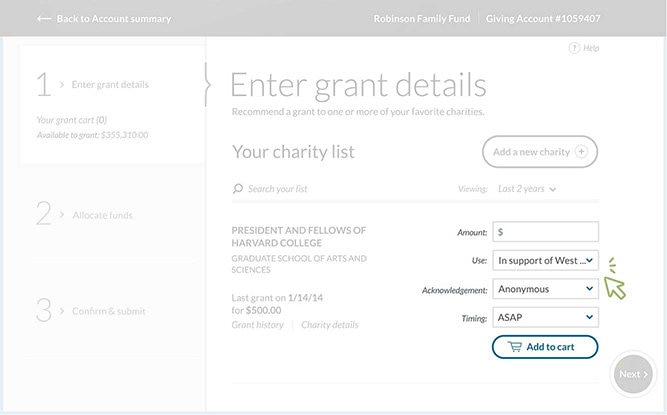

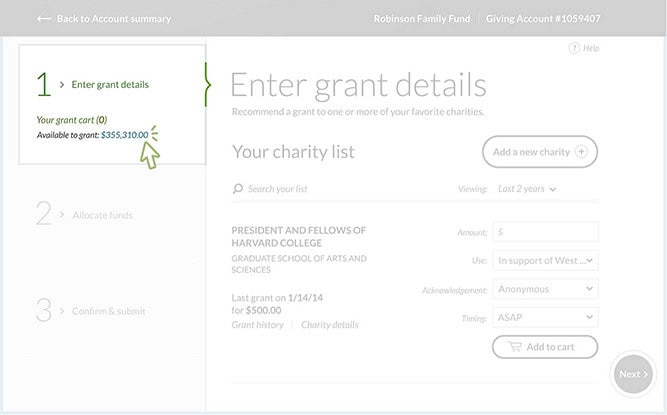

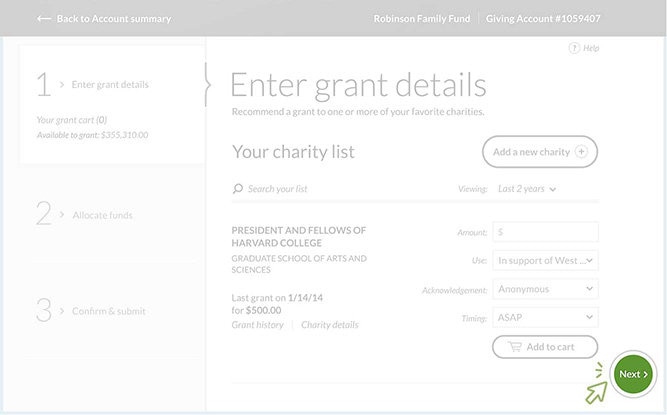

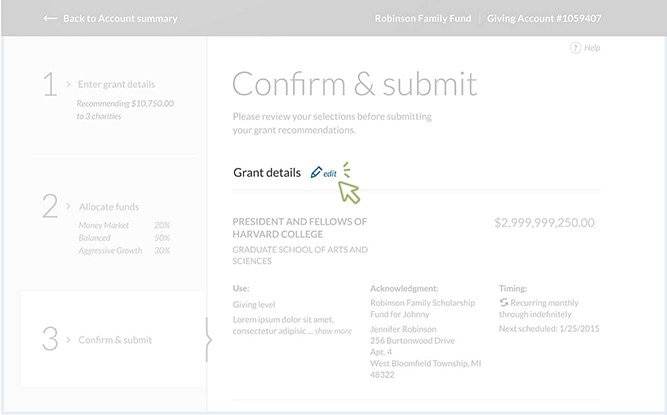

Support charities you love, now or over time

You can support 501(c)(3) IRS-qualified public charities with the money you've put into your Giving Account.

Fidelity Charitable requires active grantmaking from every Giving Account. Each individual grant must be at least $50, and you must recommend at least one grant every two years. If no grants are made within that time, Fidelity Charitable will make a grant from the Giving Account in an amount determined by the Trustees of Fidelity Charitable to an eligible grant recipient approved by the Trustees.

There is no maximum contribution limit to your Giving Account at Fidelity Charitable. However, the amount you can deduct for tax purposes each year may be limited based on IRS rules. Any excess contributions that exceed the deduction limit can typically be carried forward for up to five additional years. Consult a tax advisor to determine the best strategy for your charitable giving.

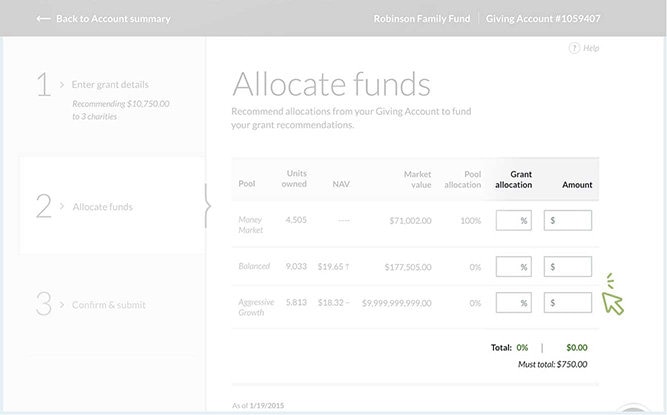

Grow your donation, tax-free

While you're deciding which charities to support, your donation can grow based on how you tell us you would like it to be invested, so your Giving Account can potentially have even more money for charities.

Like with any investment strategy, diversifying assets in a Giving Account with a suitable asset allocation is critical to help donors meet their specific charitable goals. From asset allocation pools, which offer diversification through an all-in-one, risk-based approach, to both passive and actively-managed broad market investments, we have something that will meet your specific investing style. We also have sustainable and impact investing options for those donors that want exposure to strategies that consider social and environmental factors, while also emphasizing financial returns.

You can also give your advisor access to your Giving Account to help you decide.

Yes. Just like any investment, invested donations depend on market performance. A diversified investment approach can help manage risk in your Giving Account and rebalancing is an important key to maintaining the most appropriate risk level, based on your charitable goals, over time. The Asset Allocation pools offer diversified all-in-one investment options, based on your risk tolerance level and time horizon, and are automatically rebalanced—taking the guess work out of the asset allocation decision process for our donors. Keep in mind that any decreases will not affect your tax deduction, as you would have already made a deductible contribution to Fidelity Charitable.

Yes, we have a number of resources available to help guide your investment recommendations regardless of your situation and charitable goals. Our Asset Allocation pools are all-in-one investment options that are professionally managed and available to all donors. For help in determining the right Asset Allocation pool for your goals, we created the Pool Selector tool. Plus, if your Giving Account reaches a qualified minimum balance, you’ll be eligible for our Charitable Investment Advisor Program, which allows you to nominate your own financial advisor to manage your Giving Account’s investments.

The Charitable DonorFlex Program—or DonorFlex—is for donors with more than $5 million in their Giving Account who desire flexibility beyond what investment pools offer. DonorFlex allows donors to recommend that their Giving Account assets be invested in hedge funds, private equity funds, mutual funds, treasuries and ETFs.

Resources

Giving Account fact sheet

Use this document to quickly understand the benefits of a Giving Account, administrative fees, and compare ways to give.

Giving Account brochure

The Giving Account, a donor-advised fund, is one of the easiest and most tax-advantageous ways to give to charity. Use this brochure to learn how.

Quiz: Is a donor-advised fund right for you?

Finding out is simple. Just answer a few questions, like how long you hope to contribute, the amount you plan to give, and your risk tolerance.

What it costs

No minimum

initial contribution

You can open a Giving Account with no minimum initial contribution. You don't have to maintain a minimum balance, and you can start supporting charities right away.

$100 or 0.6%*

administrative fee

This administrative fee is based on your Giving Account balance and covers our costs, like processing transactions and providing donor support. The more in your Giving Account, the lower the percentage.

*whichever is greater

0.015% to 0.89%

investment fees

These are the mutual fund fees based on how your donation is invested, just like any other account that has the potential to grow.

See what these fees could mean for you

|

Account balance |

Administrative fee* |

Investment fee** |

Total fee |

Hypothetical investment growth*** |

|---|---|---|---|---|

|

Account balance $10,000 |

Administrative fee* $100 |

Investment fee** $46 |

Total fee $146 |

Hypothetical investment growth*** $581 |

|

Account balance $100,000 |

Administrative fee* $600 |

Investment fee** $460 |

Total fee $1,060 |

Hypothetical investment growth*** $5,808 |

|

Account balance $250,000 |

Administrative fee* $1,500 |

Investment fee** $1,150 |

Total fee $2,650 |

Hypothetical investment growth*** $14,521 |

|

Account balance $500,000 |

Administrative fee* $3,000 |

Investment fee** $2,300 |

Total fee $5,300 |

Hypothetical investment growth*** $29,042 |

*Additional fees may apply for Giving Accounts enrolled in the Charitable Investment Advisor Program.

**Based on investment in the Asset Allocation 20% Equity Pool for one year. While the investment fees will vary depending on how the Giving Account balance is allocated, the administrative fee is only based on the balance itself. View all investment options

***Based on the average annual one-year return from the Asset Allocation 20% Equity Pool for May 31, 2025. View all pool performance

The fees in this chart are based on an average annual balance in your Giving Account for one year. If you recommend grants that reduce this amount, the balance in your Giving Account will be assessed accordingly. The administrative fee is assessed by Fidelity Charitable and covers our costs, whereas the investment fee is dependent on the underlying fund(s) in each pool. Additional average annual returns:

Additional average annual returns:

| Performance of | Average annual | |||

|---|---|---|---|---|

| 1 yr | 3 yr | 5 yr | 10 yr | |

| Performance of Asset Allocation 20% Equity Pool 1 | Average annual 1 yr 5.81% | Average annual 3 yr 3.55% | Average annual 5 yr 2.79% | Average annual 10 yr 2.89% |

|

Performance of

Underlying Fund: Fidelity Asset Manager 20% |

Average annual 1 yr 6.37% | Average annual 3 yr 4.15% | Average annual 5 yr 3.41% | Average annual 10 yr 3.50% |

1Pool created 07/01/2011; therefore, historic performance is not available for earlier periods. On 3/28/2024, Fidelity Charitable renamed the asset allocation pools with no change to the underlying mutual fund. The asset allocation pool renaming did not impact pool results. Pool is 100% invested in the underlying mutual fund displayed beneath the pool. Pool results will include a Fidelity Charitable annual administrative fee as described in the Program Guidelines and will therefore differ from the results of the underlying mutual fund.

Is a donor-advised fund right for me?

A donor-advised fund like the Giving Account is an easy, inexpensive way to be more strategic about your charitable giving. See for yourself.

Do more with your Giving Account

Give your financial advisor access

If you already work with a financial advisor, you can give him or her access to your Giving Account to transact on your behalf or manage the investments in your Giving Account.

Donate a variety of assets

When you use our donor-advised fund to give to charity, you're not limited to donating just cash. You can also donate stocks, bonds, and non-publicly traded assets like private business interests.

Name a successor

Whether you want to carry on a tradition of giving with your family or simply provide ongoing support for the charities you care about, the Giving Account helps you simplify your planning. You can also include a bequest to Fidelity Charitable in your will, potentially maximizing estate tax advantages.

Give the gift of giving

Share the experience of charitable giving with friends and family through a Gift4Giving® e-gift. It lets the recipient support a charity of their choice using your Giving Account. It's the perfect gift for any occasion.

Why Fidelity Charitable?

Join more than 350,000 donors who choose Fidelity Charitable to make their giving simple and more effective.

Since 1991, we have been a leader in charitable planning and giving solutions, helping donors like you support their favorite charities in smart ways.

The growth potential of donor contributions is even more impressive. Thanks to Fidelity Charitable investment programs, an additional $30 billion has been made available for charitable giving. That's a distinction matched by few organizations in the United States.

Unlike a private foundation, there are no hefty legal fees or complicated administrative tasks associated with a donor-advised fund. You can set it up easily in just a few steps, and you can manage it yourself, or with your financial advisor. It's one of the most affordable, flexible ways to give.

From world-class service to expertise in handling donations of non-publicly traded assets, we have your charitable needs covered.

Our service team is always happy to answer questions and connect you to resources that can help you achieve your charitable giving goals. You can also tap into our team of lawyers and experts for guidance on how to donate seemingly illiquid assets like private company stock, restricted stock, real estate and more.

With a Giving Account, book keeping has never been easier. You can view your Giving Account history and statements online at any time. You can even keep track of donations you've made outside Fidelity Charitable, so all your giving is organized in one place.

Plus, our mobile capability makes sure you're always connected to the causes you care about. It even lets you recommend grants to charities on the go. It's all part of our approach to simple, more effective giving.

Proven experience

Since 1991, we have been a leader in charitable planning and giving solutions, helping donors like you support their favorite charities in smart ways.

The growth potential of donor contributions is even more impressive. Thanks to Fidelity Charitable investment programs, an additional $30 billion has been made available for charitable giving. That's a distinction matched by few organizations in the United States.

Low minimums & fees

Unlike a private foundation, there are no hefty legal fees or complicated administrative tasks associated with a donor-advised fund. You can set it up easily in just a few steps, and you can manage it yourself, or with your financial advisor. It's one of the most affordable, flexible ways to give.

Expert support & service

From world-class service to expertise in handling donations of non-publicly traded assets, we have your charitable needs covered.

Our service team is always happy to answer questions and connect you to resources that can help you achieve your charitable giving goals. You can also tap into our team of lawyers and experts for guidance on how to donate seemingly illiquid assets like private company stock, restricted stock, real estate and more.

Easy-to-use tools

With a Giving Account, book keeping has never been easier. You can view your Giving Account history and statements online at any time. You can even keep track of donations you've made outside Fidelity Charitable, so all your giving is organized in one place.

Plus, our mobile capability makes sure you're always connected to the causes you care about. It even lets you recommend grants to charities on the go. It's all part of our approach to simple, more effective giving.

34

years in service

350,000+

donors

433,000+

charities supported

Ready to get started?

Opening a Giving Account is fast and easy, and there is no minimum initial contribution.

Or call us at 800-262-6039

Are you a financial advisor?

Do more for your clients—and your practice—by offering charitable planning services.