Charitable Investment Advisor Program

The Charitable Investment Advisor Program at Fidelity Charitable allows eligible independent investment advisors to actively manage the Fidelity Charitable assets contributed by their clients. Advisors assess a fee for their services and have increased investment flexibility and reporting capabilities. With this program, your clients benefit from the features of our donor-advised fund program while maintaining your trusted expertise.

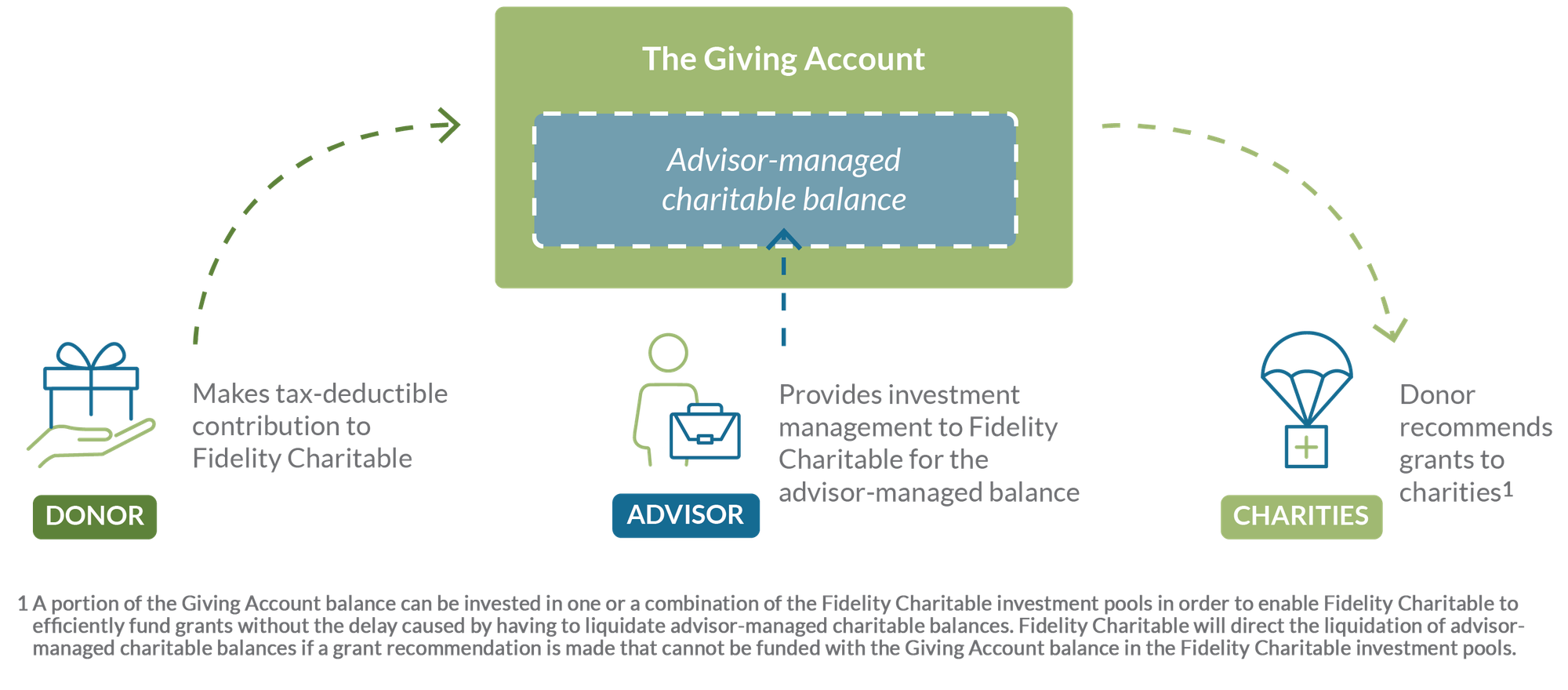

How the program works

Benefits for you

By managing Fidelity Charitable’s assets in your clients’ Giving Accounts, you can:

- Assess an advisory fee for your investment services.

- Build holistic portfolios with greater investment flexibility, including alternative assets.2

- Differentiate yourself with customized solutions to your clients’ charitable giving needs.

Benefits for your clients

By selecting the Charitable Investment Advisor Program, clients gain all the advantages of a Giving Account, plus they will:

- Continue to receive trusted professional advice for their Giving Account from their independent investment advisor.

- Obtain a more customized asset allocation than is currently available through the existing Fidelity Charitable investment pools.

- Maintain a comprehensive portfolio that aligns charitable giving with their overall financial goals.

2 Fidelity Charitable has established rigorous qualification criteria for independent advisors to ensure that Fidelity Charitable assets are being invested prudently and in accordance with the Fidelity Charitable Mission and Declaration of Trust. Please see The Charitable Investment Advisor Program: Description & Investment Policies and Guidelines for investment policies and guidelines and advisor qualification requirements. The Trustees administer the program, monitor the advisors’ investment performance, and oversee advisor compliance with the Fidelity Charitable Investment Policy and Guideline Statement.