For Advisors

Frequently asked questions

How can my clients make grant recommendations?

What are the things to keep in mind when recommending a grant?

What is the best way to recommend a grant on behalf of my client?

Where can I find the status of my client’s grant?

What do you mean by "due diligence process"?

How can my clients make grant recommendations?

Starting in late 2025, Fidelity Charitable donors are encouraged to submit grant recommendations under $10,000 online. Donors can recommend grants from their Giving Account (opens in new tab or window) or within our iOS (opens in new tab or window) or Android (opens in new tab or window) app. Advisors with transactional access can use GivingCentral (opens in new tab or window) to submit grant recommendations online.

Nonprofits added to the donor's charity list are visible to everyone with transactional access on the Giving Account. The charity list can be searched or filtered by time period.

Fidelity Charitable asks for online grant recommendations for the convenience and security of our donors and advisors. Online grant recommendations save time, reduce errors, and allow submissions on any day or time—all with the enhanced protection of a secure login and multifactor authentication. Donors and advisors who need assistance with online granting can access our guide for how to recommend a grant online for the Giving Account (opens in new tab or window) for donors or GivingCentral for advisors.

Where can I find my “favorite” grant recommendations and/or repeat a grant recommendation in GivingCentral?

From your client Giving Account summary page, hover over “History” in the menu tab and then select “Grant history.” From the list, click on the grant ID or status link to view the full details. Once on the “Grant details” page, click the regrant button in the upper right-hand corner.

What are the things to keep in mind when recommending a grant?

You can recommend a grant to virtually any IRS-qualified 501(c)(3) public charity or private operating foundations on behalf of your client, although the client may not receive a "more than incidental benefit" in return (such as tickets to a charitable event).

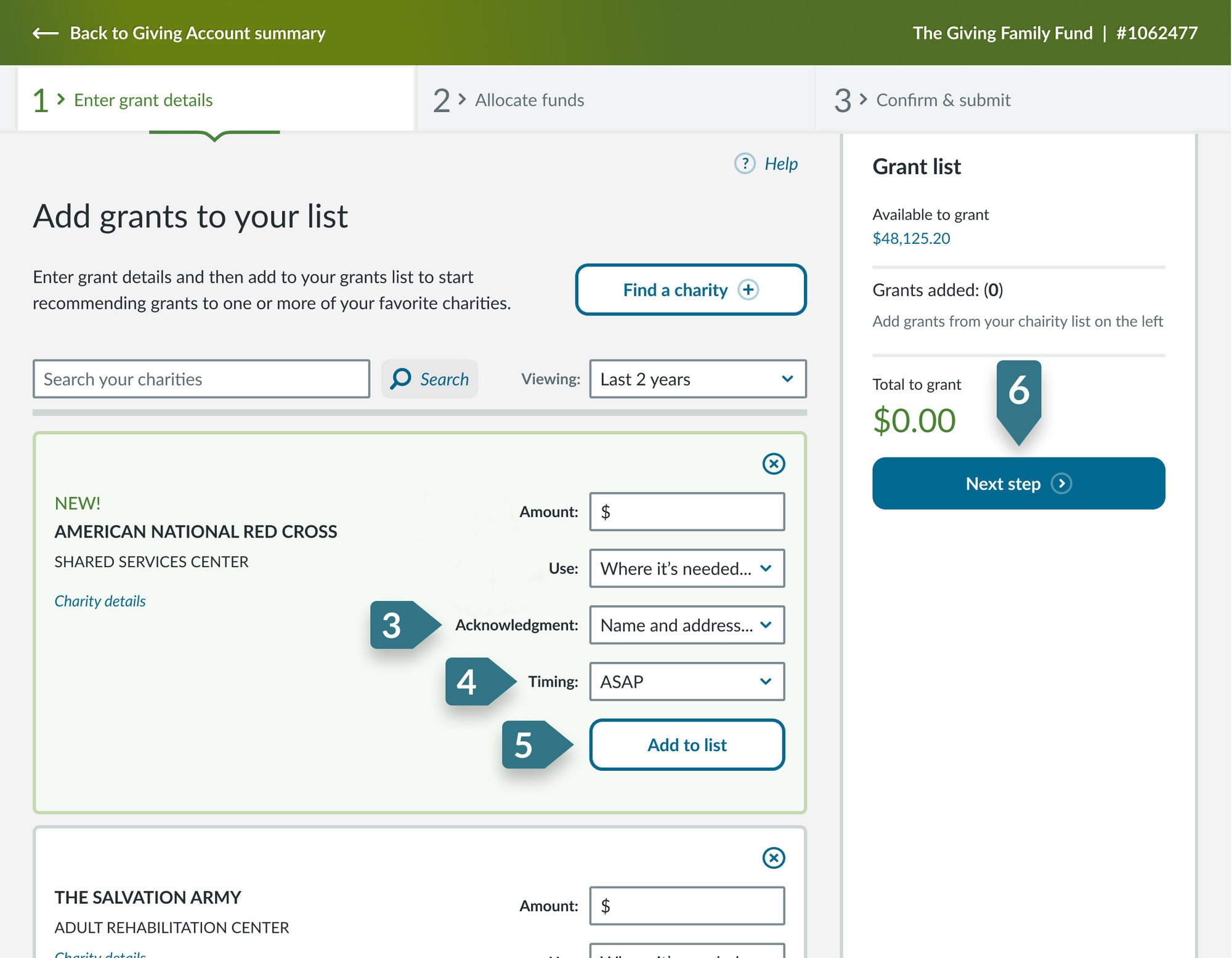

The minimum grant is $50. In addition to the amount of a grant, you can also specify your client's desired use for the funds and how they would like to be acknowledged. These details will be sent to the charity along with the grant.

What is the best way for me to recommend a grant on behalf of my client?

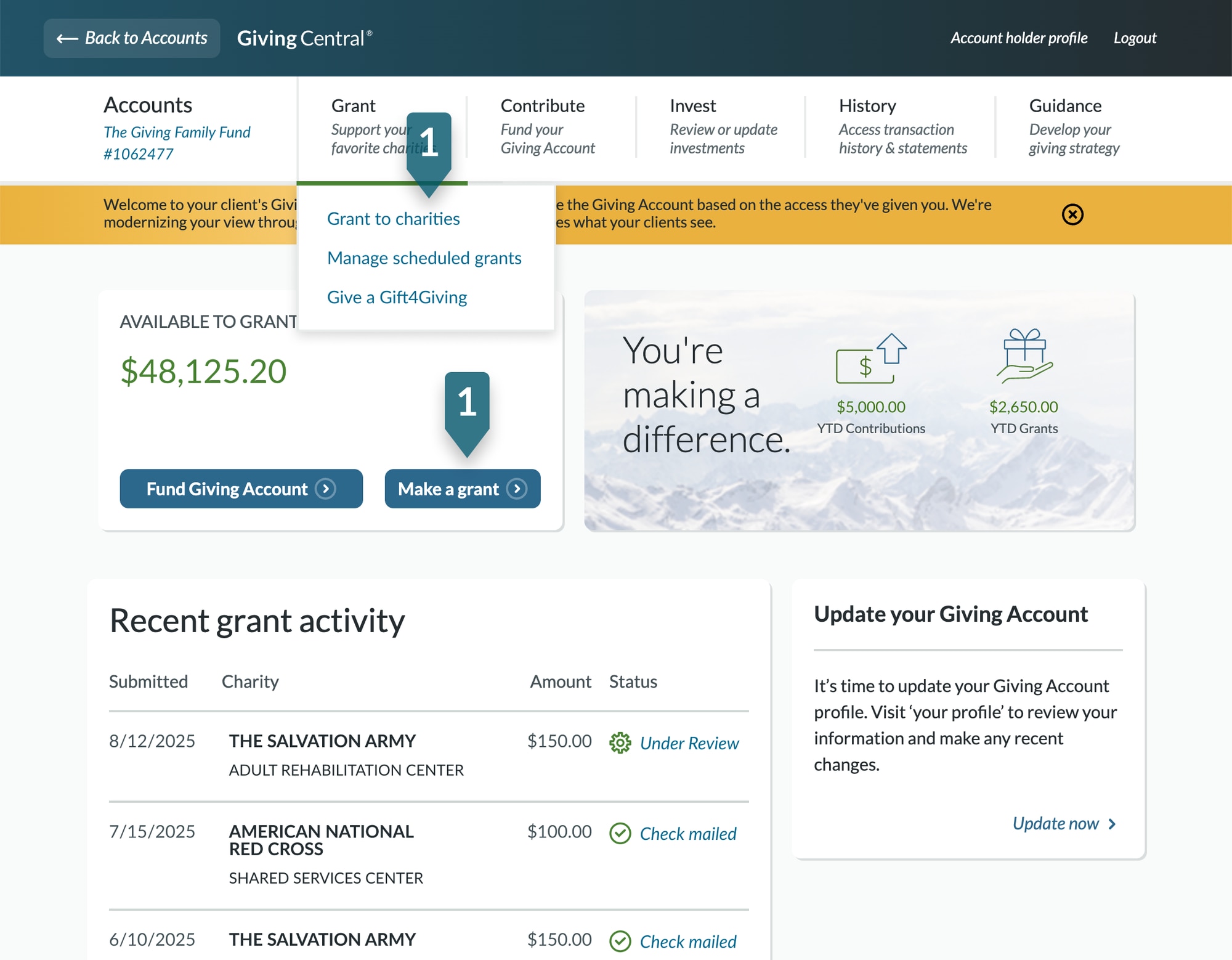

To make a grant on behalf of your client through GivingCentral, you must have transactional access on the Giving Account. Account access can be requested during the account opening process or from the GivingCentral dashboard at any time once the Giving Account is established. Once access is approved by your client, use this tutorial to walk through recommending a grant step-by-step.

Where can I find the status of my client’s grant?

You can check the grant status for your client by logging in to GivingCentral and clicking on your client’s Giving Account name. From there, go to Recent Grant Activity on the dashboard. To view more, you can hover over the History menu tab and select “Grant history.”

Your client can check the status of a grant by logging in to the donor portal, hovering over the History menu tab, selecting “Grant history,” and clicking the grant ID to view the full details, including the status.

What do you mean by "due diligence process"?

To protect the integrity of the program, and to ensure that we are following the rules outlined by the IRS for registered 501(c)(3) programs, we not only go through a process of verifying the charity but also the type of Grant being made to ensure that it qualifies. More information can be found here.

Can a grant from my client's Giving Account be recommended for the tax-deductible part of a ticket to a charitable event?

No. Bifurcated or "split" gifts cannot be made from the donor-advised fund. For example, grants intended to pay all or a portion of the cost of tickets to attend a charitable event will not be made. This includes grants for the charitable, or tax-deductible, portion of the ticket price. The FULL ticket price (the tax deductible AND non-tax deductible portions) must be paid out of pocket and separate from any Fidelity Charitable grants.

What about recommending a grant for a sponsorship?

Here’s an example: Rebecca would like to attend the Annual Gala at her favorite charity. The charity offers individual tickets priced at $500 ($250 tax-deductible) or a Patron Sponsorship for $10,000 that comes with 10 tickets for seats at a premium table ($7,500 tax-deductible). Rebecca would like to use all 10 seats so her friends and family can attend the gala with her. For Rebecca to be within Fidelity Charitable policy, she would have to pay the full minimum ticket price of $500 for each attendee, totaling $5,000.

She can recommend a grant for the remaining $5,000 from her Giving Account at Fidelity Charitable as long as this amount is considered fully tax-deductible with no goods or services being provided in connection to the grant.

Fidelity Charitable’s policies are in compliance with the Pension Protection Act of 2006 (PPA) which enacted certain laws applicable to donor-advised funds, including excise taxes on prohibited benefits under IRC section 4967.

In December 2017, the IRS released Notice 2017-73 that requested comments on potential regulations the IRS is considering with respect to donor-advised funds. The rules proposed in the Notice are largely consistent with Fidelity Charitable’s policies and procedures.

What does the term “more than incidental benefit” mean?

Grants must be recommended exclusively for charitable purposes with no more than incidental benefits to an Account Holder or related third party. A “more than incidental” benefit generally includes items with financial value, such as includes tickets to attend an event, raffle tickets, auction items, or the provision of any other goods or services. Certain items of minimal value are considered an “incidental benefit” such as logo-bearing keychains, coffee mugs, or calendars.