For Advisors

Frequently asked questions

What levels of access can my client assign me and what is the process for doing so?

Can I be alerted on the status of activity for my client’s Giving Account?

How does my client see their account online?

Can I manage employee access privileges at my firm?

Where can I find the details regarding the Admin Fees on a Giving Account?

How can I setup a successor for my client?

My client has inherited a Giving Account – what do we need to do?

What levels of access can my client assign me and what is the process for doing so?

We offer advisors transactional and non-transactional access. Review this chart with your client to determine which level is appropriate.

Advisor Access levels

Compare access features

View: Giving Account balance, contribution history, and grant history

Non-Transactional

Transactional

Compare access features

View: Giving Account statements and tax forms

Non-Transactional

Transactional

Compare access features

Initiate irrevocable contributions

Non-Transactional

Transactional

Compare access features

Recommend grants*

Non-Transactional

Transactional

Compare access features

Reallocate between investment pools

Non-Transactional

Transactional

Compare access features

Update donor contact information

Non-Transactional

Transactional

Compare access features

Add or modify successor information

Non-Transactional

Transactional

Compare access features

Obtain Giving Account information online or via phone

Non-Transactional

Transactional

*Advisors enrolled in the Charitable Investment Advisor Program must complete an Agency Agreement prior to recommending a grant.

Account access can be requested during the account opening process or from the GivingCentral dashboard at any time once the Giving Account is established. From the dashboard, select Request Account Access from the upper right corner of the dashboard. Next, you will be prompted to enter your client’s name, Giving Account number and desired access level. If you do not know the Giving Account number, you can alternatively provide your client’s date of birth and the last four digits of his/her social security number. Once your client approves, access should occur immediately.

Can I be alerted on the status of activity for my client’s Giving Account?

Yes, this can be done through the Alert Manager Tool on GivingCentral. Upon logging in:

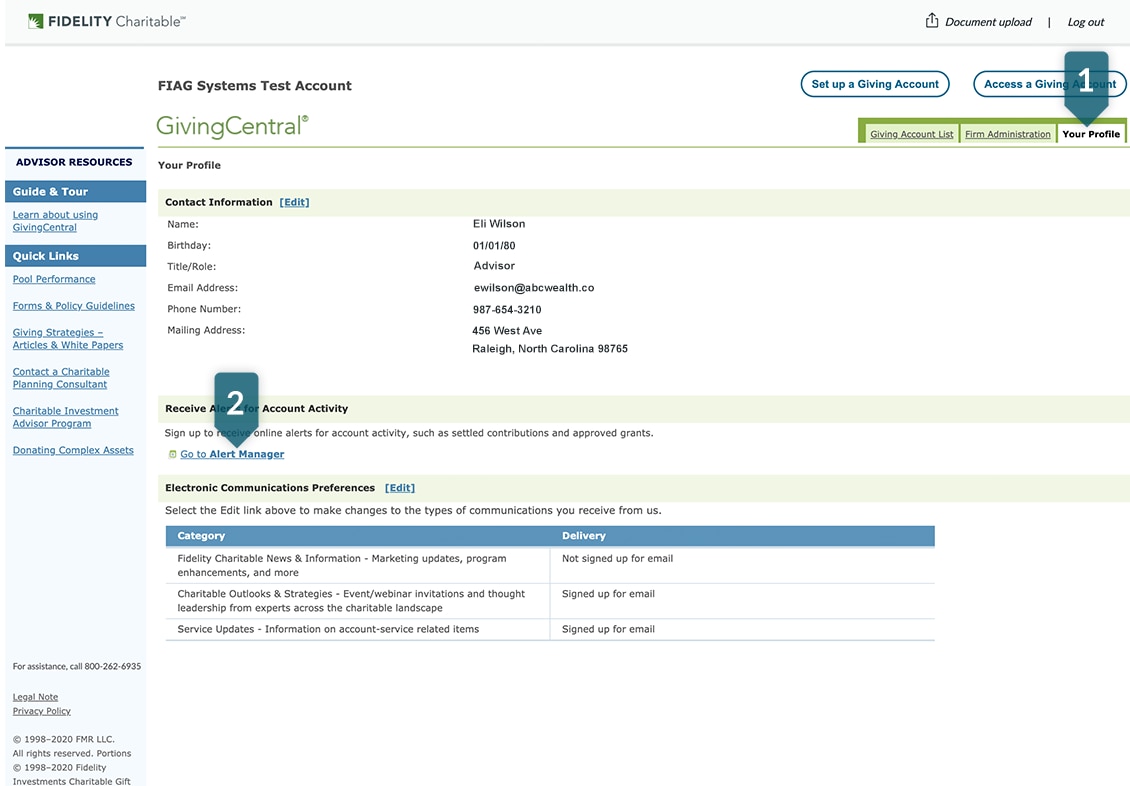

1. Navigate to the Profile tab in the upper right corner of your GivingCentral dashboard.

2. Select Go to Alerts Manager just below your contact information. Read and accept the user agreement.

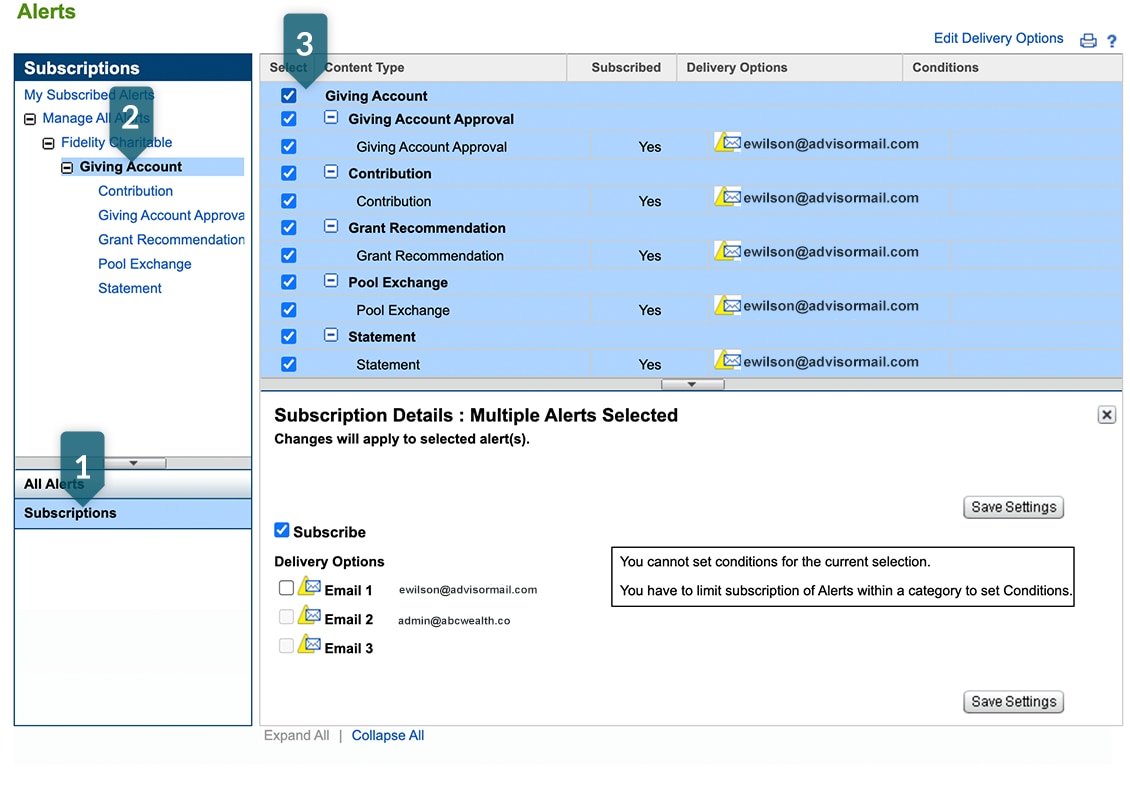

3. Expand the subscriptions menu along the left side of the screen: Manage all alerts > Fidelity Charitable> Giving Account. From here, you have the option to subscribe to all alerts or only those you’d like to receive.

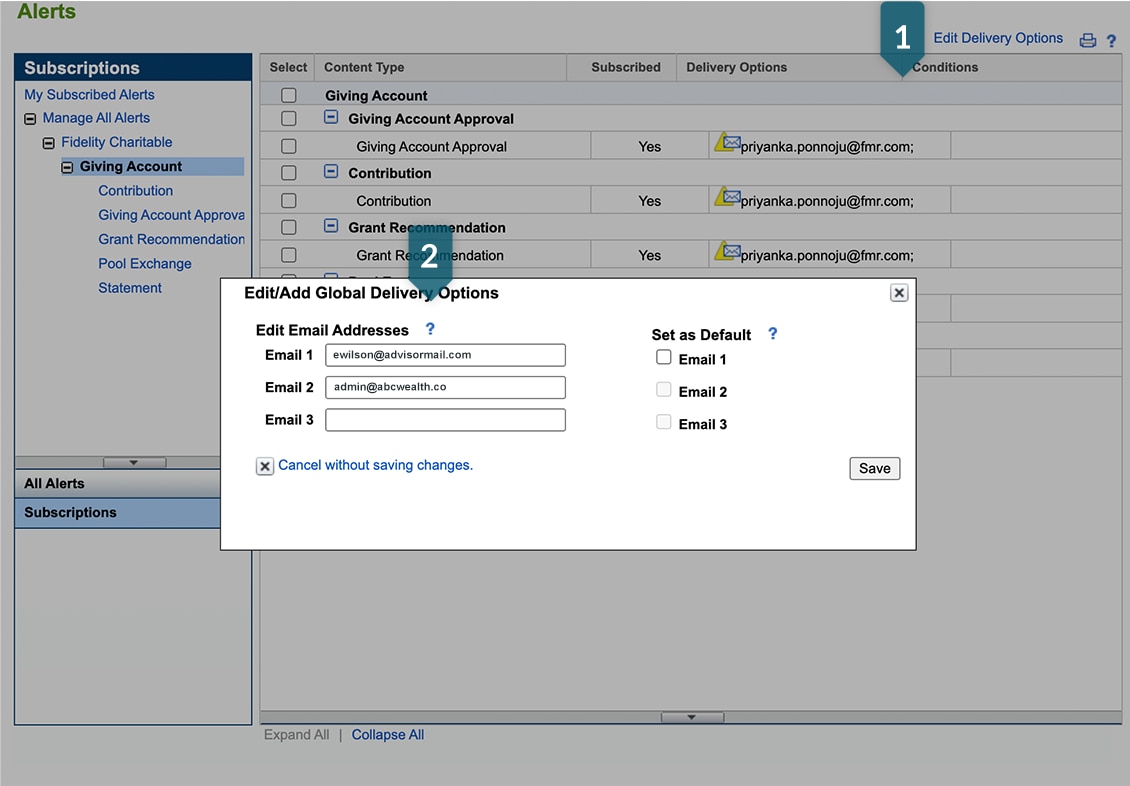

4. Edit your delivery options and save settings. You may add up to three email addresses per Giving Account to receive each alert.

How does my client see their account online?

They can access these details by logging into their Giving Account, or if your client has an existing brokerage account with Fidelity Investments, they can use the link in their portfolio view for single sign on.

This demo gives you a glimpse into the donor platform your client uses.

Can I manage employee access privileges at my firm?

Firms that use Wealthscape and have their G Number added to a Giving Account can manage access via their firm administrator by using the User ID Maintenance Tool.

Where can I find the details regarding the Admin Fees on a Giving Account?

The Administrative Fee is based on the Giving Account balance. View our tiered fee structure. The fee covers our costs, like processing transactions and providing donor support.

How can I setup a successor for my client?

A successor, or successors, is critical to continuing your clients charitable giving beyond their lifetime. Naming an individual, charity, or combination of both establishes a giving tradition and continues support of the causes they care about. Advisors with transactional access can add/edit successors on behalf of a client at any time via GivingCentral. Once logged in, select the appropriate Giving Account from the list of Active Giving Accounts. From there, select the Profile tab. You will have the option to add/edit a successor, contact information, and the percentage allocated (if applicable).

My client has inherited a Giving Account – what do we need to do?

Fidelity Charitable allows Account Holders to name successors on their Giving Account. This means your client will have advisory privileges on charitable assets, based on the information provided by our Account Holder. In order to get started, please send a copy of the Account Holder’s Death Certificate to Fidelity Charitable via fax 877-665-4274. Once received, the successor will receive a packet with a letter detailing the Giving Account information, a grant recommendation form, a donor application, and a copy of the program guidelines. The successor has the option to grant the funds out of the deceased donor’s Giving Account or create their own Giving Account.

If your client chooses to open a new giving account, the most efficient way for you to setup the new account for your client is online. Please make sure to include the G number and all the required information. Please notified Fidelity Charitable in order to ensure accurate and timely transfer of the assets.