Charitable remainder trusts

Charitable giving while generating income

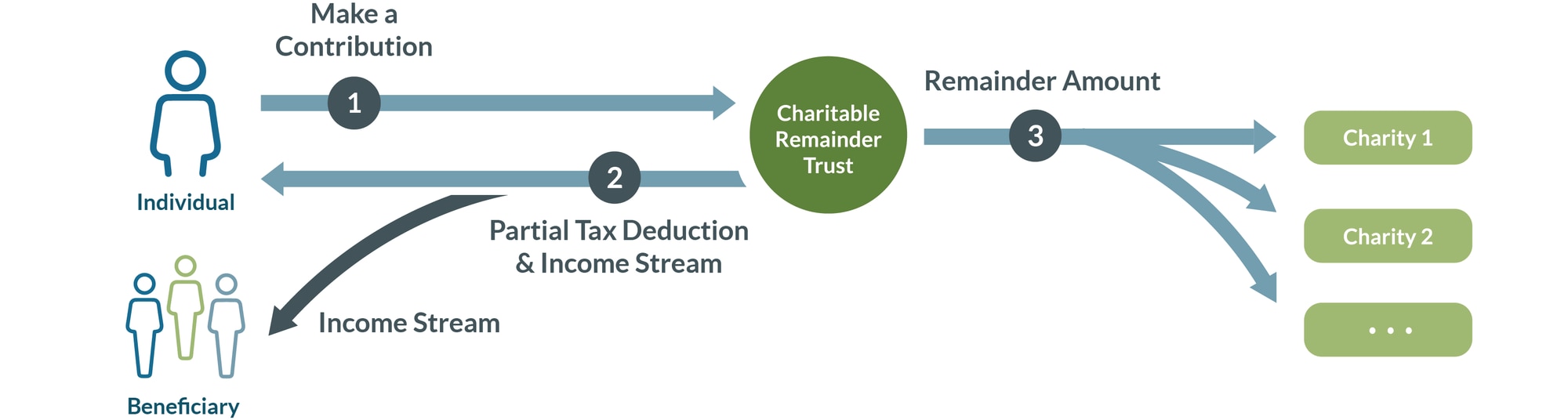

A charitable remainder trust (CRT) is an irrevocable trust that generates a potential income stream for you, as the donor to the CRT, or other beneficiaries, with the remainder of the donated assets going to your favorite charity or charities.

This charitable giving strategy generates income and can enable you to pursue your philanthropic goals while also helping provide for living expenses. Charitable trusts can offer flexibility and some control over your intended charitable beneficiaries as well as lifetime income, thereby helping with retirement, estate planning and tax management.

How a charitable remainder trust works

A charitable remainder trust is a “split interest” giving vehicle that allows you to make contributions to the trust and be eligible for a partial tax deduction, based on the CRT’s assets that will pass to charitable beneficiaries. You can name yourself or someone else to receive a potential income stream for a term of years, no more than 20, or for the life of one or more non-charitable beneficiaries, and then name one or more charities to receive the remainder of the donated assets.

There are two main types of charitable remainder trusts:

- Charitable remainder annuity trusts (CRATs) distribute a fixed annuity amount each year, and additional contributions are not allowed.

- Charitable remainder unitrusts (CRUTs) distribute a fixed percentage based on the balance of the trust assets (revalued annually), and additional contributions can be made.

Contributions to CRATs and CRUTs are an irrevocable transfer of cash or property and both are required to distribute a portion of income or principal, to either the donor or another beneficiary. At the end of the specified lifetime or term for the income interest, the remaining trust assets are distributed to one or more charitable remainder beneficiaries.

1. Make a partially tax-deductible donation

Donate cash, stocks or non-publicly traded assets such as real estate, private business interests and private company stock and become eligible to take a partial tax deduction. The partial income tax deduction is based on the type of trust, the term of the trust, the projected income payments, and IRS interest rates that assume a certain rate of growth of trust assets.

2. You or your chosen beneficiaries receive an income stream

Based on how you set up the trust, you or your stated beneficiaries can receive income annually, semi-annually, quarterly or monthly. Per the IRS, the annual annuity must be at least 5% but no more than 50% of the trust’s assets.

3. After the specified timespan or the death of the last income beneficiary, the remaining CRT assets are distributed to the designated charitable beneficiaries.

When the CRT terminates, the remaining CRT assets are distributed to the charitable beneficiary, which can be public charities or private foundations. Depending on how the CRT is established, the trustee may have the power to change the CRT's charitable beneficiary during the lifetime of the trust.

Combine a CRT with a donor-advised fund

Achieve greater flexibility by combining strategies of using a charitable trust with a donor-advised fund (DAF). If you make the beneficiary of a charitable trust a public charity that sponsors a DAF, you give yourself the flexibility to more easily adjust and recommend ultimate grants with the DAF. This strategy provides you with greater flexibility at a significantly lower cost than amending the charitable beneficiary of a charitable trust, which in some circumstances may be prohibited.

Key benefits

- Preserve the value of highly appreciated assets: For those with significantly long-term appreciated assets, including non-income-producing property, a CRT allows you to contribute that property to the trust and when the trust sells it is exempt from tax. By donating the assets in-kind to the CRT, you’ll preserve the full fair market value of the assets rather than reduce it by large capital gains taxes, allowing more money for the income and charitable beneficiaries.

- Income tax deductions: With a CRT, you have the potential to take a partial income tax charitable deduction when you fund the trust, which is based on a calculation on the remainder distribution to the charitable beneficiary.

- Tax exempt: The CRT’s investment income is exempt from tax. This makes the CRT a good option for asset diversification. You may consider donating low-basis assets to the trust so that when sold, no income tax is generated to you and you eliminate the capital gains tax on the sale of the asset. However, the named income beneficiary will pay income tax on the income stream received.

What assets may be donated to a CRT?

You can use the following types of assets to fund a charitable remainder trust.

- Cash

- Publicly traded securities

- Some types of closely held stock (Note that CRTs cannot hold S-Corp stock)

- Real estate

- Certain other complex assets

Is a charitable remainder trust right for me?

The CRT is a good option if you want an immediate charitable deduction, but also have a need for an income stream to yourself or another person. It is also a good option if you want to establish one by will to provide for heirs, with the remainder going to charities of your choosing. There are a variety of charitable giving vehicles from which to choose. Compare ways to give to help you choose which is best.

How Fidelity Charitable can help

Since 1991, we have been helping donors like you support their favorite charities in smarter ways. We can help you explore the different charitable vehicles available and explain how you can complement and maximize your current giving strategy with a donor-advised fund. Join more than 395,000 donors who choose Fidelity Charitable to make their giving simple and more effective.

Ready to get started?

Opening a Giving Account is fast and easy, and there is no minimum initial contribution.

Or call us at 800-262-6039