Fidelity Charitable Giving Report key findings

Trends and motivations that informed donors' charitable support.

Fidelity Charitable today is the nation’s second-largest grantmaker behind the Bill & Melinda Gates Foundation,1 propelled by the collective generosity of nearly 150,000 donors who actively use their Giving Accounts. Last year, our donors recommended $3.5 billion in grants to support more than 114,000 charitable organizations in every state and around the globe.2

As more people use donor-advised funds to plan their giving, their impact on the charitable sector has grown. But many other trends influencing philanthropy also emerge in this report. Not only are donors increasingly using efficient, tax-effective means to plan their giving, but more and more people are giving in smarter ways that create greater impact. Donors also are giving in response to issues and events they see happening in our increasingly interconnected world.

Key insights into our donor activity include:

Donors actively and generously recommend grants.

- Last year, Fidelity Charitable made $3.5 billion in donor-recommended grants. Grant dollars to charity have tripled in the last decade. The number of grants of $1 million or more has grown by five times.

- Over the last 10 years, the average number of grants per Giving Account has grown from 6.2 to 9.3 annually, while the average grant amount has remained at about $4,200.

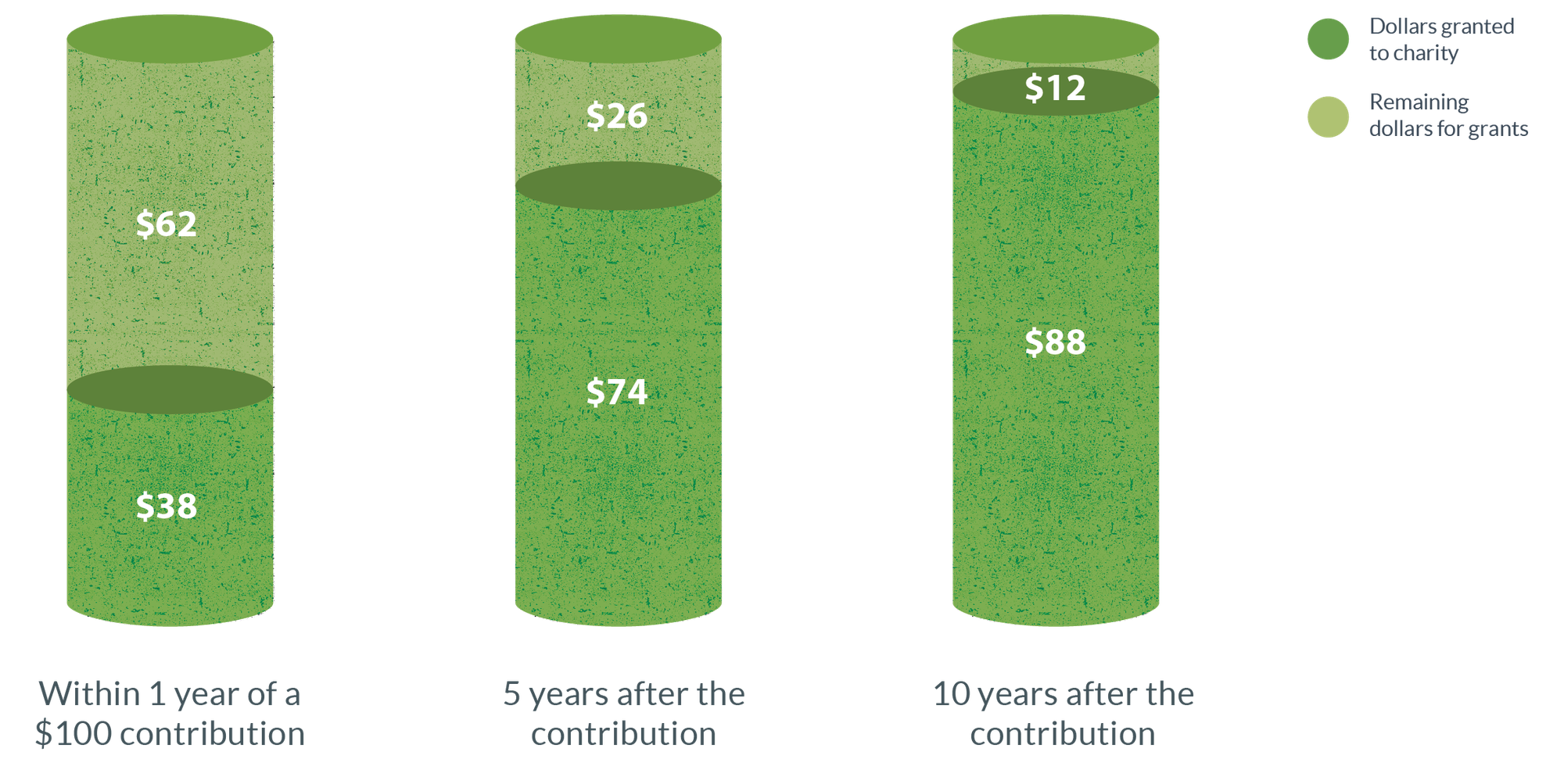

- Three-quarters of donors’ contribution dollars are granted within five years of receipt.

Pace of contributions granted to charity

Steady—and frequently local—impact is a hallmark of donor-advised fund giving.

- Donors supported more than 114,000 nonprofits in 2016. Most of these nonprofits are smaller, local organizations that receive gifts from only a handful of Giving Accounts.

- This local impact adds up: $1.8 billion of 2016 grant dollars went to organizations in donors’ home states.

- Donors are consistent in their support; in 2016, three-quarters of donor-recommended grants went to charities that donors had previously supported.

Donors continue to use their Giving Accounts as a “ready reserve” for responsive philanthropy; interest in impact investing continues to grow.

- Giving in response to the 2016 election and the Syrian refugee crisis drove changes in how some donors supported charities last year.

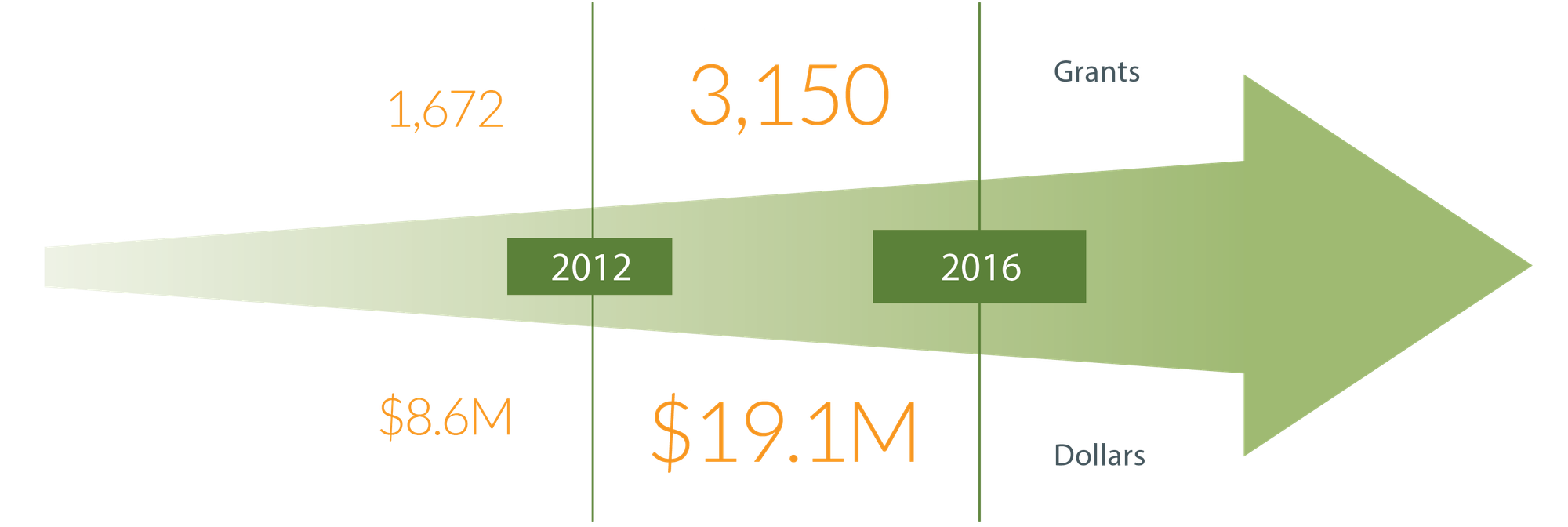

- The number of grants to impact investing nonprofits has doubled in the last five years, reflecting a growing interest in organizations that can achieve social benefits alongside financial returns.

Grant volumes and dollars to impact investing nonprofits

Donors continue to adopt tax-savvy giving methods that can lead to more dollars for charity.

- The number of Fidelity Charitable Giving Accounts has nearly doubled in 10 years, from 47,000 donors to more than 90,000. Many donors establish Giving Accounts so they can easily contribute assets other than cash. While most charitable contributions in the United States are given with cash,3 60 percent of 2016 donor contributions to Fidelity Charitable were non-cash assets, such as stocks or mutual funds.

- In 2016, donors contributed a record amount of non-publicly traded assets—almost $800 million in restricted stock, limited partnership interests, Bitcoin and other assets—potentially generating dollars for charity that would not otherwise be available to give.

- Since inception, Giving Account asset investment growth has generated 4.5 billion in additional charitable dollars available for grants.

Percentage of asset types contributed in 2016, by dollars

Want to learn more about this approach to smart, impactful giving? Read about donor-advised funds.

1Based on a comparison of Fidelity Charitable grant dollars with the grants made by private, corporate, and community foundations, as listed in the Foundation Center's "Top 100 U.S. Foundations by Total Giving" list.

2The 2017 Fidelity Charitable Giving Report is based on data from Fidelity Charitable’s internal reporting database, unless otherwise indicated.

3Internal Revenue Service, Statistics of Income Bulletins.

How Fidelity Charitable can help

Since 1991, we have been a leader in charitable planning and giving solutions, helping donors like you support their favorite charities in smart ways.

Or call us at 800-262-6039