Research on tax reform and charitable giving

New Fidelity Charitable research shows donors plan to maintain their giving levels in 2018, but may not understand the impact of tax reform on their donations.

Updated October 9, 2018

Last December, sweeping tax code changes were passed through the Tax Cuts and Jobs Act. While tax reform left the charitable deduction intact, other changes in the code, particularly an increase in the standard deduction, have led to questions about the potential impact of tax reform on charitable giving.

New research among American donors who itemized deductions on their 2017 taxes indicates that donors’ commitment to giving remains strong in the wake of tax reform. However, the research also demonstrates that many taxpayers may not fully understand how the new reforms will impact them and are unaware of strategies that may help them keep the tax deductions they’re expecting while maintaining their charitable giving.1

Impact of tax reform on giving

Four out of five donors (82 percent) plan to maintain or increase their giving in 2018, despite changes in the tax code. This includes 63 percent planning to give the same amount and 19 percent planning to increase the amount they give.

This solid commitment reaffirms what we already know about donor motivations for giving: giving back or making a difference are the primary drivers of charitable giving. That said, more than 37 million taxpayers claimed a charitable giving deduction on their 2017 taxes,2 and our research demonstrates many are still working through how the tax law changes will impact them.

An itemization understanding gap

While the Tax Cuts and Jobs Act left the charitable deduction intact, one of the most significant reforms enacted was to increase the standard deduction to $12,000 for individuals and $24,000 for married couples filing jointly. Estimates predict this will drop the number of households itemizing deductions from 46 million to 19 million, a 59 percent decrease in itemizers.2 That’s because the things they once itemized, such as property taxes and charitable contributions, may not add up to exceed the higher standard deduction thresholds.

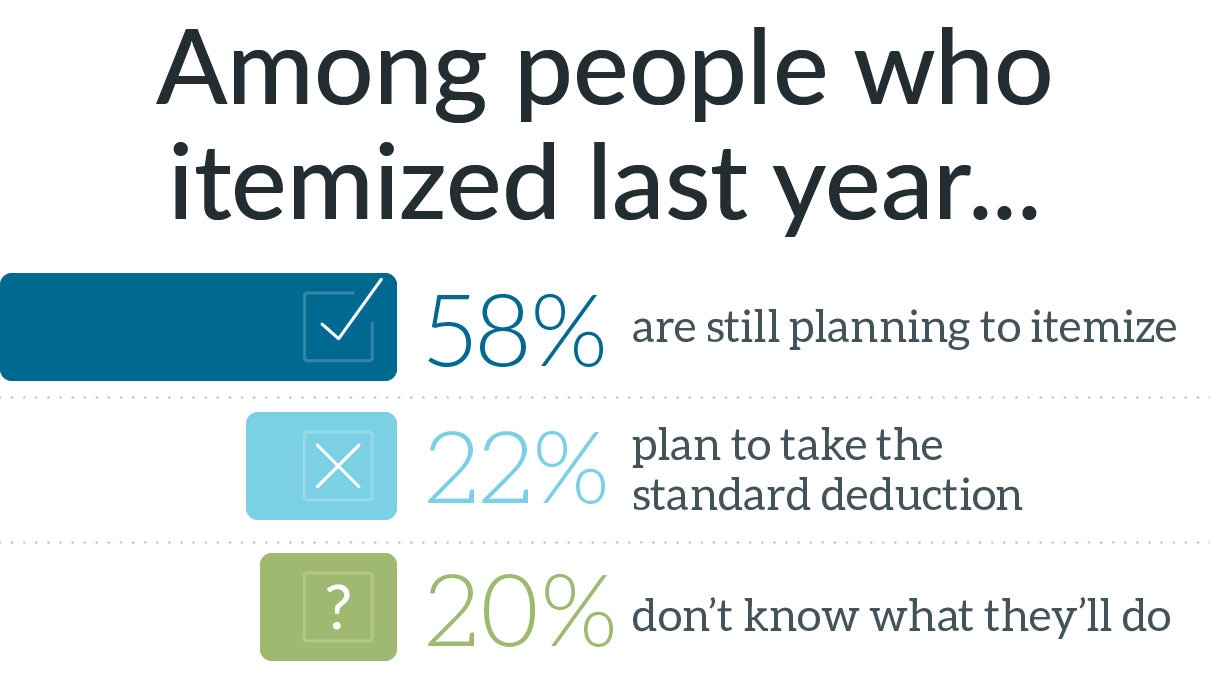

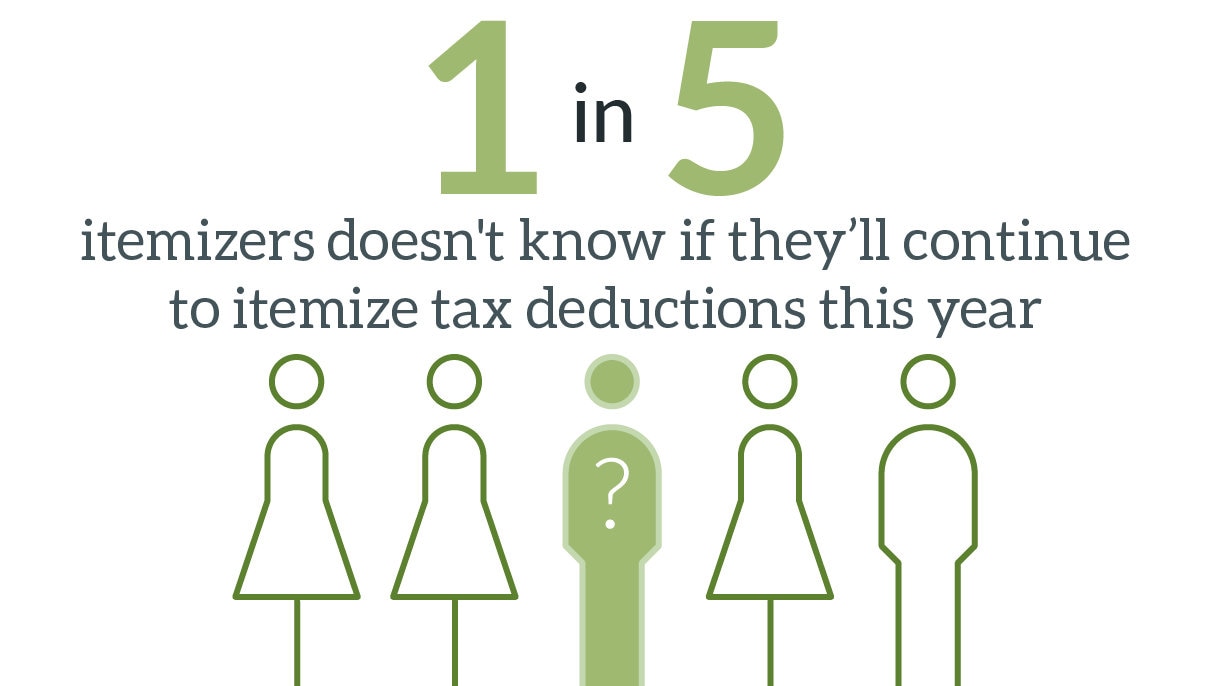

One in five donors (20 percent) still aren’t sure if they’ll continue to itemize deductions following these changes, although they had itemized previously. This could translate into as many as 7.4 million households.

But that number may underrepresent the true amount of confusion. More than half of donors (58 percent) are still planning to itemize in 2018—though itemizing may not be right for their situation. These donors know about tax reform in the abstract but have not fully considered how the increased standard deduction affects them. For example, 51 percent of households with incomes under $100,000 currently plan to itemize their 2018 taxes. It is likely that most donors at this income level will discover that their itemizations, including charitable donations, will not push the total deduction amount past the new standard deduction thresholds of $12,000 and $24,000.

Given experts predict a nearly 60 percent drop in the number of taxpayers who itemize, it is clear many taxpayers have not worked through how tax reform might affect them personally.

Helping donors maintain tax benefits through “bunching”

Given the confusion around the new tax law, it is not surprising donors are unaware of strategies available to manage deductions.

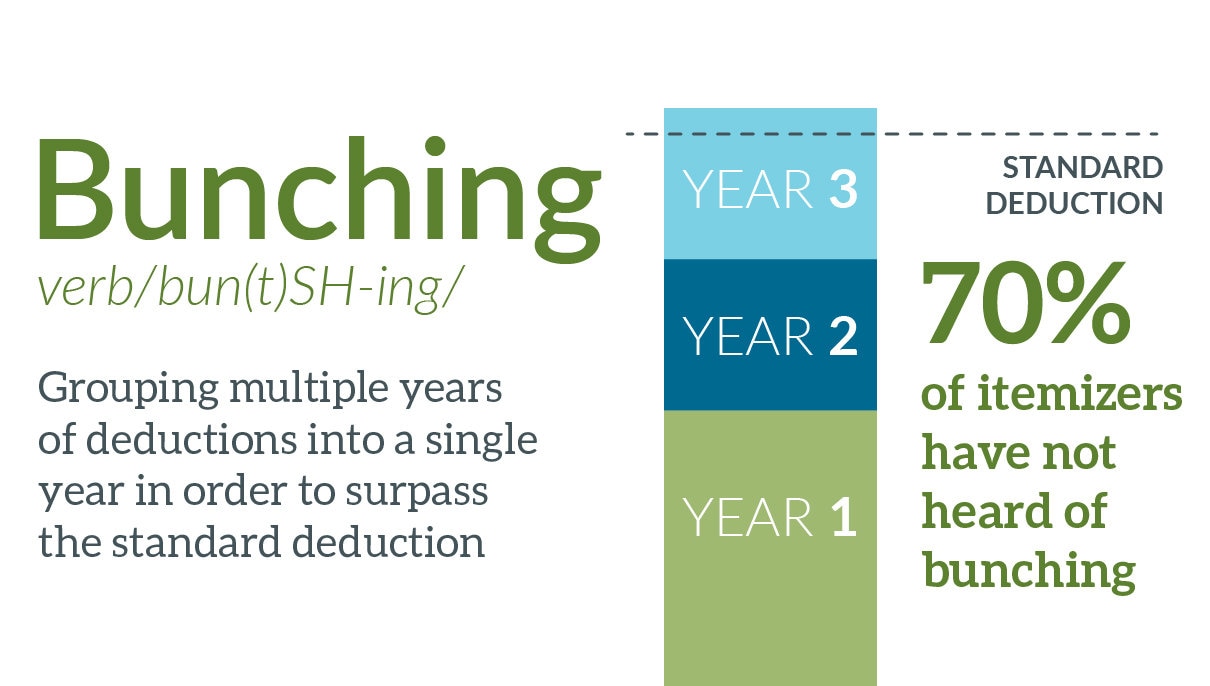

Bunching, sometimes called stacking, is a strategy where taxpayers bundle multiple years of tax deductions into one year to surpass the standard deduction threshold and receive greater tax savings. Bunching brings charitable contributions into play because charitable giving is often easier to increase or decrease as compared with state income tax or mortgage interest deductions.

Only 30 percent of itemizers have heard of bunching or stacking—meaning 70 percent of donors who itemized tax deductions had never heard of this strategy and could be missing out on ways to maximize their tax savings—including their charitable deductions.

Next steps

In all, these findings demonstrate taxpayers may still be on autopilot from 2017 and have not updated their tax strategy to align with tax code changes. Given the confusion around the new standard deduction, it may take until they file their 2018 taxes to completely absorb the impact of the changes and potentially adjust charitable plans. Therefore tax reform’s influence on giving at large will likely not be fully known until 2019.

Given donors’ desire to maintain giving combined with information gaps around tax reform, our research also reinforces the need for education around post tax reform charitable strategies. More than a third of charitable giving occurs in the final three months of the year, with many waiting until December to make donations. Without understanding their options, taxpayers may not be able to make the decisions that would allow them to best maximize their 2018 giving.

With this in mind, financial and tax advisors should be proactive in reaching out to clients with guidance on how they may wish to alter their philanthropic plans this year. Similarly, charitable donors should take steps to arm themselves with answers regarding the impact of tax reform on their personal situations, to best position them to make the best decisions regarding their year-end giving. These questions include whether they should make any adjustments to their giving plans, whether to give assets other than cash, and whether to make use of strategies such as bunching or the use of charitable giving vehicles.

Charitable giving is a core value and commitment for a majority of American taxpayers. As they approach their first “giving season” following tax reform, donors can affirm that commitment even as they potentially adjust their approach to maximize their giving levels.

Learn more about smart charitable tax strategies.

1Data in this article is based on 2018 research from Fidelity Charitable. Data about itemizing income tax deductions is from a survey of 3,000 Americans who in 2017 made charitable donations and itemized tax deductions on their federal returns. Data about 2018 giving and bunching is from a survey of 475 Americans who made donations to charity within the last two years and itemized tax deductions on their last federal tax return.

2Tax Policy Center,“ Effects of the Tax Cuts and Jobs Act,” 2018.

Want more info before you open a Giving Account?

Sign up to receive occasional news, information and tips that support smarter philanthropic impact through a donor-advised fund.

How Fidelity Charitable can help

Since 1991, we have been a leader in charitable planning and giving solutions, helping donors like you support their favorite charities in smart ways.

Or call us at 800-262-6039