Study finds 50 percent of surveyed taxpayers made at least one change to their charitable giving strategy after tax reform

While respondents say they are likely to give the same amount or more to charity this year, half reported adjusting their giving strategy through tactics like bunching, donating appreciated securities, or using a donor-advised fund

Those who work with a financial advisor were more likely to increase charitable contributions

Despite significant public discussion ahead of tax reform taking effect, nearly one third of respondents were surprised by their 2018 returns

BOSTON, MA, November 5, 2019 – Half of surveyed taxpayers made at least one change in their charitable giving strategy after the Tax Cuts and Jobs Act, according to a survey analysis released today by Fidelity Charitable, an independent public charity and the nation’s largest grantmaker. The study asked about any potential impact that the recent tax law changes might have had to their charitable giving.

“It is encouraging to see that those with the most to give plan to continue to give generously in the years to come,” said Tony Oommen, Charitable Planning Consultant, Fidelity Charitable. “While recent reports show that individual giving as a whole may have been slightly reduced by recent tax reform, we are glad to see the commitment to giving staying strong. We’re also encouraged that many donors are making adjustments to help them continue to maximize their giving, such as contributing to donor-advised funds, which provide a mechanism for those with charitable intentions to commit funds for that purpose and continue their planful giving over time.”

While the majority of taxpayers did not change the total dollar amount donated to charity after tax reform, 50 percent say they made an adjustment to their charitable giving strategy, like contributing to a donor-advised fund or donating appreciated securities to charity. For those who changed their total charitable giving dollars, tax reform was one of a variety of factors that influenced the decision. But for those who gave less to charity, tax reform was the most frequently cited reason.

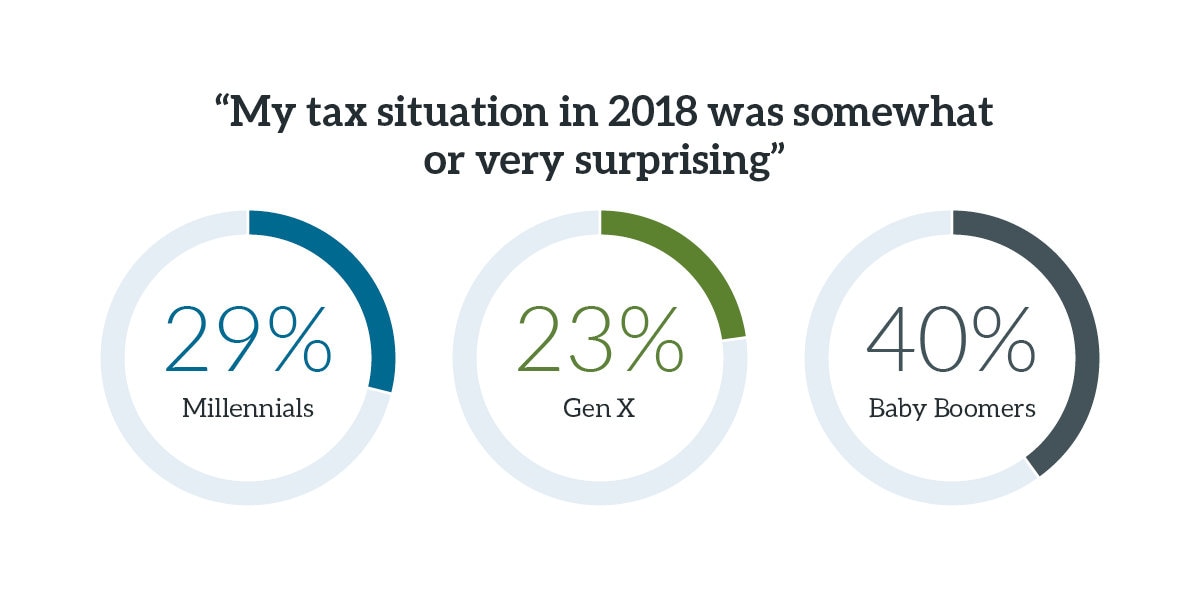

Additionally, despite the changes that many taxpayers made in their approaches to giving, a third were surprised about their tax situation after filing their 2018 returns. More than half of that group reported that their situation was worse than expected. Older taxpayers were disproportionately surprised—with 40 percent of Baby Boomers saying they were surprised, compared to only 29 percent of Millennials and 23 percent of Gen Xers.

“Both individual taxpayers and their financial advisors should examine their tax situations closely in light of recent reform to identify opportunities to maximize deductions through charitable giving,” Oommen said. “For those with a desire to give back, effective pre-planning is now more important than ever.”

Key findings:

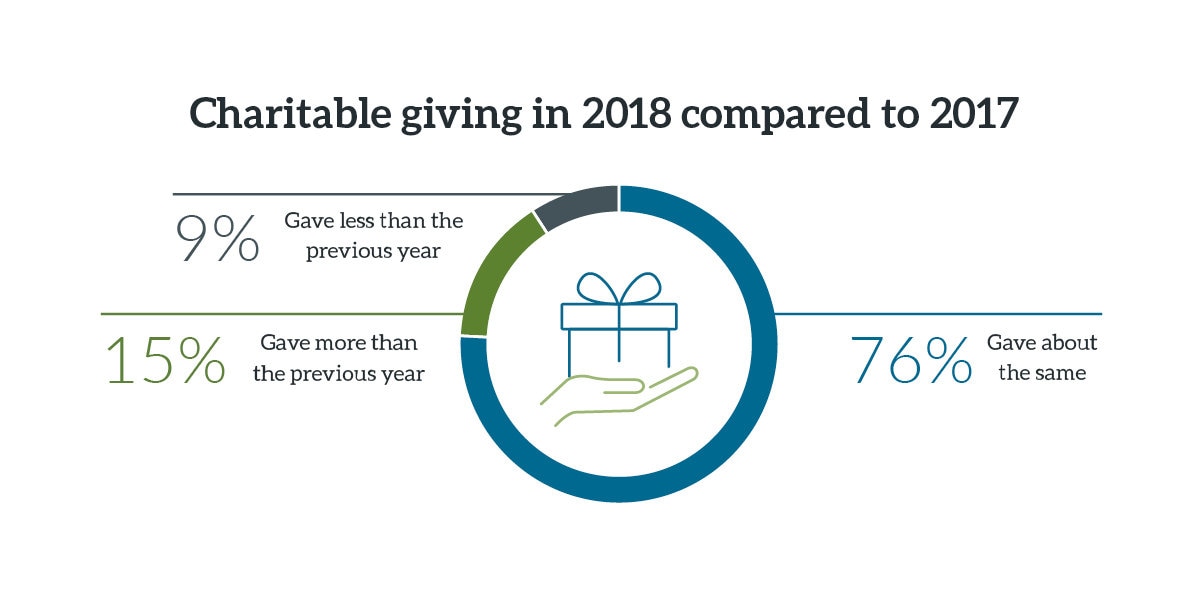

- Most consumers did not adjust the total dollar amount of their charitable giving in response to tax reform. Seventy-six percent of taxpayers donated about the same amount to charity in 2018 as they did the previous year. Fifteen percent gave more.

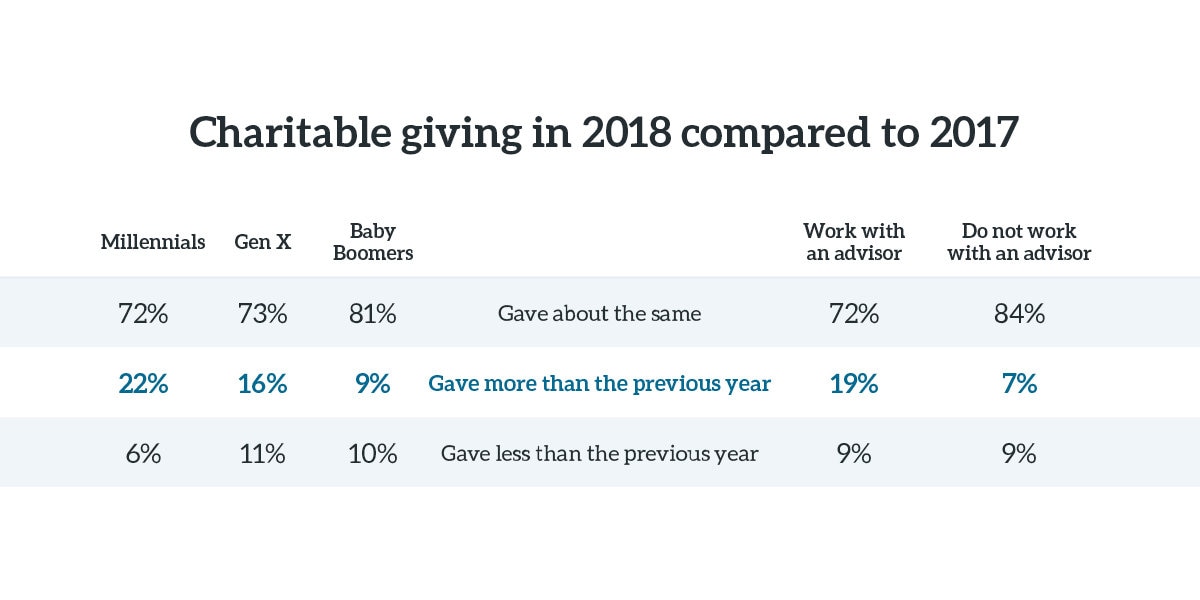

- Millennials were more likely to have increased their charitable giving in 2018 than Gen Xers and Baby Boomers, although this is likely due to reasons other than tax reform, such as income growth or life stage. Taxpayers who work with a financial advisor were more likely to increase their giving.

- Of those who gave more to charity in 2018, the biggest driver for increased giving was a request from a nonprofit; 32 percent said this motivated their desire to give more.

- Only nine percent of taxpayers say they gave less in 2018 than the previous year, but the new tax law was the most influential factor in this decision: with 48 percent of those who gave less citing tax reform as the reason.

- While most kept their total dollar amount unchanged, 50 percent of taxpayers reported making at least one change in their charitable giving strategy, such as contributing to a donor-advised fund, “bunching” several years’ of charitable gifts into a single year, or donating appreciated stock.

- Three-quarters of taxpayers say they will give about the same in 2019. Despite the significant group of taxpayers who were surprised by their tax situation in 2018, 75 percent of taxpayers say they will give about the same in 2019. This could be a missed opportunity for taxpayers to substantially improve their tax situations in 2019.

For additional detail on the study and reporting methodology, visit https://www.fidelitycharitable.org/insights/donors-adapting-to-tax-reform.html.

Resources for effective charitable planning and tax strategies can be found here: https://www.fidelitycharitable.org/guidance/charitable-tax-strategies.html

About Fidelity Charitable

Fidelity Charitable is an independent public charity that has helped donors support more than 294,000 nonprofit organizations with more than $40 billion in grants. Established in 1991, Fidelity Charitable launched the first national donor-advised fund program. The mission of the organization is to grow the American tradition of philanthropy by providing programs that make charitable giving accessible, simple and effective.For more information about Fidelity Charitable, visit https://www.fidelitycharitable.org.

Want to learn more?

Explore other news and resources, or reach out to us for a media inquiry.