Time is running out to make tax-deductible contributions in 2025. Review our year-end contribution guidelines.

Time is running out to make tax-deductible contributions in 2025. Review our year-end contribution guidelines.

Charitable giving while generating income

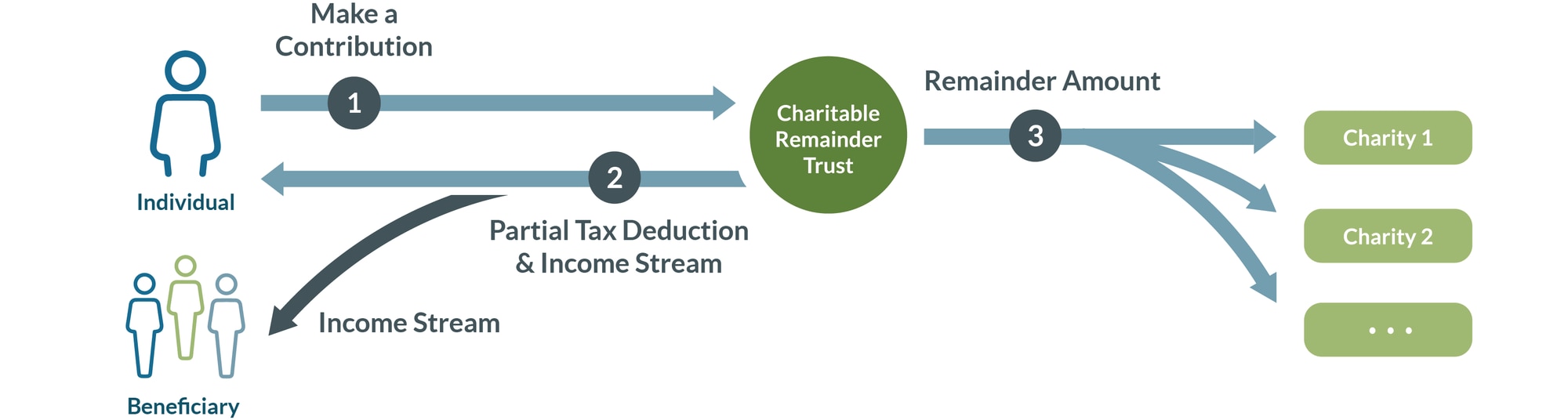

A charitable remainder trust (CRT) is an irrevocable trust that generates a potential income stream for you, as the donor to the CRT, or other beneficiaries, with the remainder of the donated assets going to your favorite charity or charities.

This charitable giving strategy generates income and can enable you to pursue your philanthropic goals while also helping provide for living expenses. Charitable trusts can offer flexibility and some control over your intended charitable beneficiaries as well as lifetime income, thereby helping with retirement, estate planning and tax management.

A charitable remainder trust is a “split interest” giving vehicle that allows you to make contributions to the trust and be eligible for a partial tax deduction, based on the CRT’s assets that will pass to charitable beneficiaries. You can name yourself or someone else to receive a potential income stream for a term of years, no more than 20, or for the life of one or more non-charitable beneficiaries, and then name one or more charities to receive the remainder of the donated assets.

There are two main types of charitable remainder trusts:

Contributions to CRATs and CRUTs are an irrevocable transfer of cash or property and both are required to distribute a portion of income or principal, to either the donor or another beneficiary. At the end of the specified lifetime or term for the income interest, the remaining trust assets are distributed to one or more charitable remainder beneficiaries.

1. Make a partially tax-deductible donation

Donate cash, stocks or non-publicly traded assets such as real estate, private business interests and private company stock and become eligible to take a partial tax deduction. The partial income tax deduction is based on the type of trust, the term of the trust, the projected income payments, and IRS interest rates that assume a certain rate of growth of trust assets.

2. You or your chosen beneficiaries receive an income stream

Based on how you set up the trust, you or your stated beneficiaries can receive income annually, semi-annually, quarterly or monthly. Per the IRS, the annual annuity must be at least 5% but no more than 50% of the trust’s assets.

3. After the specified timespan or the death of the last income beneficiary, the remaining CRT assets are distributed to the designated charitable beneficiaries.

When the CRT terminates, the remaining CRT assets are distributed to the charitable beneficiary, which can be public charities or private foundations. Depending on how the CRT is established, the trustee may have the power to change the CRT's charitable beneficiary during the lifetime of the trust.

Achieve greater flexibility by combining strategies of using a charitable trust with a donor-advised fund (DAF). If you make the beneficiary of a charitable trust a public charity that sponsors a DAF, you give yourself the flexibility to more easily adjust and recommend ultimate grants with the DAF. This strategy provides you with greater flexibility at a significantly lower cost than amending the charitable beneficiary of a charitable trust, which in some circumstances may be prohibited.

You can use the following types of assets to fund a charitable remainder trust.

The CRT is a good option if you want an immediate charitable deduction, but also have a need for an income stream to yourself or another person. It is also a good option if you want to establish one by will to provide for heirs, with the remainder going to charities of your choosing. There are a variety of charitable giving vehicles from which to choose. Compare ways to give to help you choose which is best.

Since 1991, we have been helping donors like you support their favorite charities in smarter ways. We can help you explore the different charitable vehicles available and explain how you can complement and maximize your current giving strategy with a donor-advised fund. Join more than 350,000 donors who choose Fidelity Charitable to make their giving simple and more effective.

Ready to get started?

Opening a Giving Account is fast and easy, and there is no minimum initial contribution.

Or call us at 800-262-6039