9 ways to reduce your taxable income by giving to charity

If you're writing checks to your favorite charities, if you’re a pre-retiree and especially if you’ve had a high-income year, there may be opportunities to reduce your taxable income that you haven’t taken full advantage of—and the Giving Account from Fidelity Charitable can help with all of them.

Federal taxes

Currently in effect for high-income earners

Top ordinary income tax rate: 37%

Top long-term capital gains tax rate: 20%

Medicare surtax of 3.8% on net investment income over certain thresholds*

*Applies to portion of net investment income that exceeds AGI of $200,000 (if single) or $250,000 (if married, filing jointly).

1. Think beyond cash as a donation.

Instead of writing checks, look at your portfolio with an eye toward donating long-term appreciated securities (stocks, mutual funds, bonds), real estate, private company stock (S-corp or C-corp) and other potential investments.

See the full list of assets accepted by Fidelity Charitable.

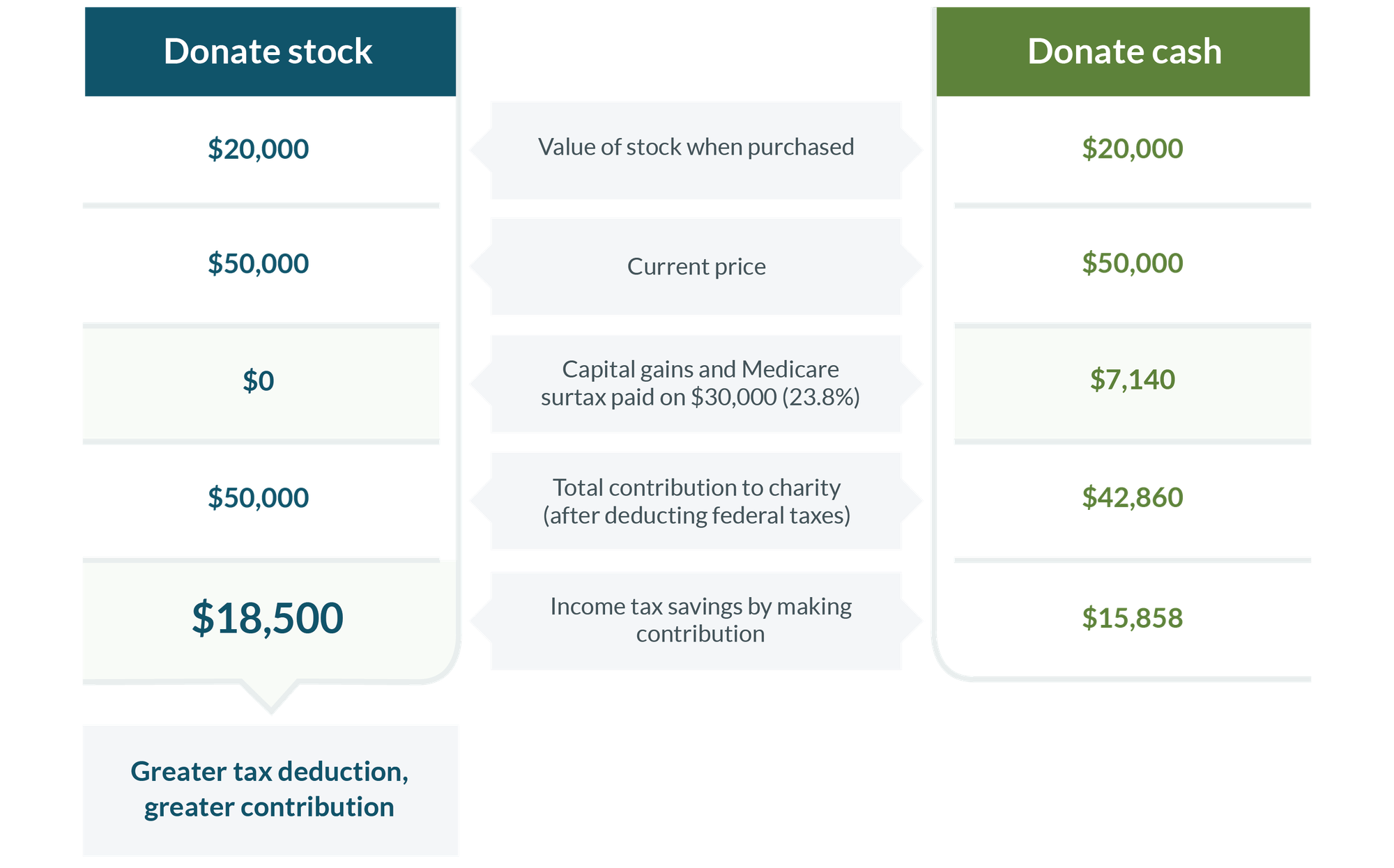

Why? Capital gains taxes are eliminated when you contribute long-term appreciated assets directly to a charity, like Fidelity Charitable, instead of selling the assets yourself and donating the after-tax proceeds. When you assume 20% for federal long-term capital gains taxes, plus a 3.8% Medicare surtax, this leads to a potential increase of 23.8% of both your tax deduction and your charitable contribution.

How donating appreciated securities can reduce taxes

This is a hypothetical example for illustrative purposes only. The chart assumes that the donor is in the 37% federal income bracket. State and local taxes and the federal alternative minimum tax are not taken into account. Please consult your tax advisor regarding your specific legal and tax situation. Information herein is not legal or tax advice. Assumes all realized gains are subject to the maximum federal long-term capital gains tax rate of 20% and the Medicare surtax of 3.8%. Does not take into account state or local taxes, if any.

See the impact of contributing securities with long-term appreciation, with the Fidelity Charitable securities donation calculator.

Use the appreciated assets donation calculator

2. Create a larger current year deduction by combining cash and securities.

While donating appreciated securities typically eliminates long-term capital gains exposure, you are limited to 30% of your adjusted gross income (AGI) for deducting contributions of long-term appreciated securities. This is sufficient for most people, but there are some years when you might benefit from a larger current year deduction. In those select situations, you may choose to supplement a charitable gift of securities with a charitable contribution of cash. This strategic combination of giving is an opportunity to reduce your taxable income.

Fidelity Investments customers can use the Fidelity Charitable Appreciated Securities Tool when making a contribution to help find the most highly appreciated securities from your portfolio.

3. Consider a donor-advised fund for charitable giving.

Whatever assets you choose to give, consider a donor-advised fund. It's a simple, tax-effective way to dedicate money to charitable giving: you make a donation of cash or other assets, become eligible to take a tax deduction for your charitable gift since the donor-advised fund is a program of a public charity, then recommend which qualified charities you'd like to support. The timing is flexible, as are the number of charitable causes you support: as many as you like. A donor-advised fund, like the Giving Account at Fidelity Charitable, offers another bonus: the opportunity to recommend how your contribution is invested for potential tax-free growth, possibly providing additional charitable support in the long run.

4. Planning for retirement? Set up and fund a donor-advised fund now, turning your currently high tax bracket into an advantage.

Establishing a donor-advised fund before you retire is an easy, tax-efficient way to make charitable giving a priority in retirement. And there’s potential for a more immediate benefit as well: substantially offsetting your current taxes.

If your tax bracket is higher now than what you expect it to be in the future, consider frontloading your charitable giving by making a large contribution now, rather than smaller gifts in retirement. Not only will you gain the possibility of tax savings in the present year but you’ll also have charitable contributions set aside to recommend as future grants, allowing you to continue supporting charities generously on a fixed income—at a point in your life when you have more time to focus on philanthropy.

5. Offset alternative minimum taxes possibly for this year and next.

If you are subject to the alternative minimum tax (AMT), making additional charitable gifts claimed as itemized deductions could reduce the difference between regular income tax and AMT . This is particularly useful because many commonly itemized deductions are added back to income under the AMT, including state and local income taxes, real estate taxes, home mortgage interest (if the loan was not used to buy, build or improve a home).*

For those who are charitably inclined, and are likely to be subject to the AMT year after year, it may make sense to make a charitable contribution in the current year. However, even though a taxpayer may receive a tax benefit for a charitable gift when they are subject to the AMT, they might consider deferring the contribution to a year when they are out of the AMT to take advantage of a potentially larger tax benefit. Talk with your tax advisor about your personal situation.

*The availability of certain federal income tax deductions may depend on whether you itemize deductions. Charitable contributions of capital gains property held for more than one year are usually deductible at fair market value. Deductions for capital gains property held for one year or less are usually limited to cost basis.

6. Make a charitable gift to offset capital gains through portfolio rebalancing.

Many shrewd investors perform routine portfolio rebalancing to ensure that their investment mix is consistent with their goals. Often this involves selling investments that have done well, which generates capital gains taxes in the process.

One simple offsetting measure is aligning your charitable giving with the rebalancing process. Instead of writing a check to a favorite charity this year, consider donating your most highly appreciated security, which you have held for over a year. Capital gains taxes typically will not apply to you or the charity receiving the donation, and because you didn’t write a check, you may have cash available to purchase more stocks as part of your rebalancing exercise.

7. Take a multi-year approach toward deductions.

If your income is particularly high this year, perhaps as the result of a year-end bonus, or you’ve sold a business, benefited from an inheritance or otherwise, consider that charitable contribution deductions may be carried forward for up to five years. You are required to claim the maximum deduction possible in the current year—the deductibility limits are 60% of AGI for cash and 30% for long-term appreciated securities—but you can then carry forward any unused charitable deductions for up to five more years. These carried-forward deductions must be used to the extent possible in the next tax year and are considered after any current year charitable contribution deductions. That’s the power of front-loading in a high-income year.

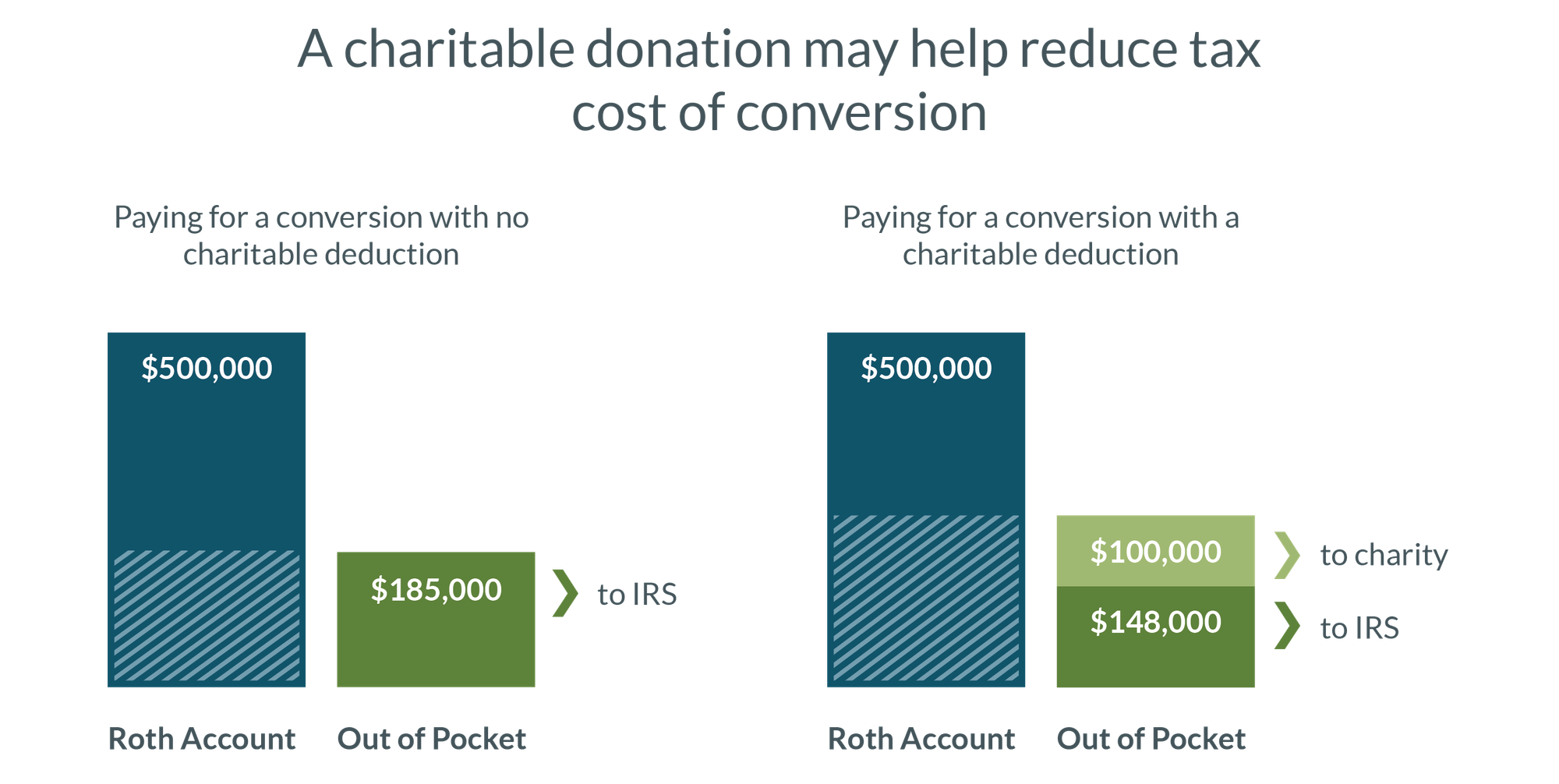

8. Make a charitable donation to offset the tax costs of converting a traditional IRA to a Roth IRA.

Converting a traditional IRA to a Roth IRA typically means paying significant taxes, but making a charitable contribution can help offset that income. This strategy may work if you already donate regularly to charity, have sufficient non-retirement assets to pay the cost of the conversion and would consider making a larger-than-usual charitable donation to Fidelity Charitable to establish a Giving Account in the year of the conversion.

Hypothetical tax amounts assume a 37% federal tax rate, a $500,000 Roth conversion amount and a $100,000 fully deductible charitable contribution. The federal alternative minimum tax, and state and local taxes are not taken into account.

9. Combine a donor-advised fund with an existing private foundation, charitable remainder trust or charitable lead trust.

Even if you already have another charitable giving vehicle, there are many tax advantages to complementing it with a donor-advised fund like the Giving Account.

Private foundations: To start, the deduction limitations for charitable donations to a public charity are greater than those to a private foundation.

Cash

Public Charity (including one with a donor-advised fund program)

60% of AGI

Private Foundation

30%

Long-term appreciated securities

Public Charity (including one with a donor-advised fund program)

30% of AGI

Private Foundation

20%

And practically speaking, making a portion of your charitable contributions to a public charity with a donor-advised fund program could free you from time-consuming paperwork and due diligence. (At Fidelity Charitable, we handle administrative tasks like ensuring that all grants are made to qualified charities and for proper charitable purposes, as well as handling compliance with legal requirements.)

Charitable remainder trusts and charitable lead trusts: It's possible to have both a donor-advised fund and a charitable remainder trust or a charitable lead trust in parallel. But a smart way to couple either type of trust with a donor-advised fund like the Giving Account is to make Fidelity Charitable a beneficiary of the trust. This gives you flexibility in deciding which charities to support from your donor-advised fund, without having to pay an attorney to update the beneficiaries of the trust over time.

The tax information provided is general and educational in nature, and should not be construed as legal or tax advice. Fidelity Charitable does not provide legal or tax advice. Content provided relates to taxation at the federal level only. Charitable deductions at the federal level are available only if you itemize deductions. Rules and regulations regarding tax deductions for charitable giving vary at the state level, and laws of a specific state or laws relevant to a particular situation may affect the applicability, accuracy or completeness of the information provided. As a result, Fidelity Charitable cannot guarantee that such information is accurate, complete or timely. Tax laws and regulations are complex and subject to change, and changes in them may have a material impact on pretax and/or after-tax results. Fidelity Charitable makes no warranties with regard to such information or results obtained by its use. Fidelity Charitable disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Always consult an attorney or tax professional regarding your specific legal or tax situation.

How Fidelity Charitable can help

Since 1991, we have been helping donors like you support their favorite charities in smarter ways. We can help you explore the different charitable vehicles available and explain how you can complement and maximize your current giving strategy with a donor-advised fund. Join more than 350,000 donors who choose Fidelity Charitable to make their giving simple and more effective.

Ready to get started?

Opening a Giving Account is fast and easy, and there is no minimum initial contribution.

Or call us at 800-262-6039